For a couple of years now, I’ve been warning that one consequence of the broken housing market will be politics and that the first domino to fall will be the so-called “corporate landlords.” I based that on things that people like Elizabeth Warren were saying in Senate hearings. I know that a number of cities have already moved on things like rent control or other efforts to try to appear as if they’re actually doing something about high home prices and high rents.

The latest comes from Minnesota, where the a dozen Democrat (DFL in Minnesota) Representatives and five Democrat Senators have proposed a bill to “encourage and protect home ownership and the single-family home as a basic housing option, to allow families increased access to housing through homeownership, for families to build equity and wealth through their housing, and to enhance and promote the stability and well-being of families and society in Minnesota.”

The bill is HF 685 and its companion in the Senate SF 365. Seeing as how the Minnesota Legislature is controlled by the Democrats, and one of the authors of the Senate bill is the Majority Leader Kari Dziedzic… and the governor is a Democrat, this bill has a pretty good chance of becoming law.

I found the bill interesting for a few reasons.

First, it codifies the idea that there is something especially bad about having corporations be landlords, versus other kinds of organizations becoming landlords.

Second, it accomplishes next to nothing while virtue signaling like mad for actual housing affordability and availability.

Third, it does this ‘next to nothing’ while punishing Minnesota homeowners and eroding private property rights.

I can’t help but feel like the whole point is to create additional avenues for corruption while doing nothing of value, but getting all of the media credit and support from uninformed voters and people who don’t read beyond the headlines.

Now… while this bill was filed in Minnesota, so I will spend some time thinking about and talking about Minnesota, the politics that drove this bill exists in all 50 states and in the country as a whole. We are likely to see similar bills filed in other states, in other municipalities, and even in Congress before the year is out. Change the names, change the parties, change the locations… but the motivations are the same.

Which is why you all should care about it no matter where you live.

The Virtue Signaling of HF 685

Let us take it as a given that the stated intent — to encourage home ownership, single family homes as a basic housing option, and to increase access to these homes for families to build equity and wealth through homeownership, etc. — is actually the goal of the bill’s sponsors and authors.

To advance this noble purpose the bill states:

(a) No corporate entity, real estate developer, or residential building contractor shall:

(1) directly or indirectly purchase, own, build, acquire, or otherwise obtain any interest in property classified as class 1a under section 273.13, subdivision 22; and

(2) subsequently convert the property into nonhomestead residential real estate containing one rental unit.

So far so good. (That “and” and “subsequently” are important, by the way.)

The virtue signaling comes from the Definitions section that precedes this prohibition. In that section, we find this:

(c) “Corporate entity” means any partnership, corporation, limited liability company, pension or investment fund, or trust but does not include a nonprofit corporation, a family trust, or a family limited liability company.

Well, by exempting “nonprofit corporation, a family trust or a family LLC” from the definition of “corporate entity” despite them being very much a corporate entity… the bill is quite without a point.

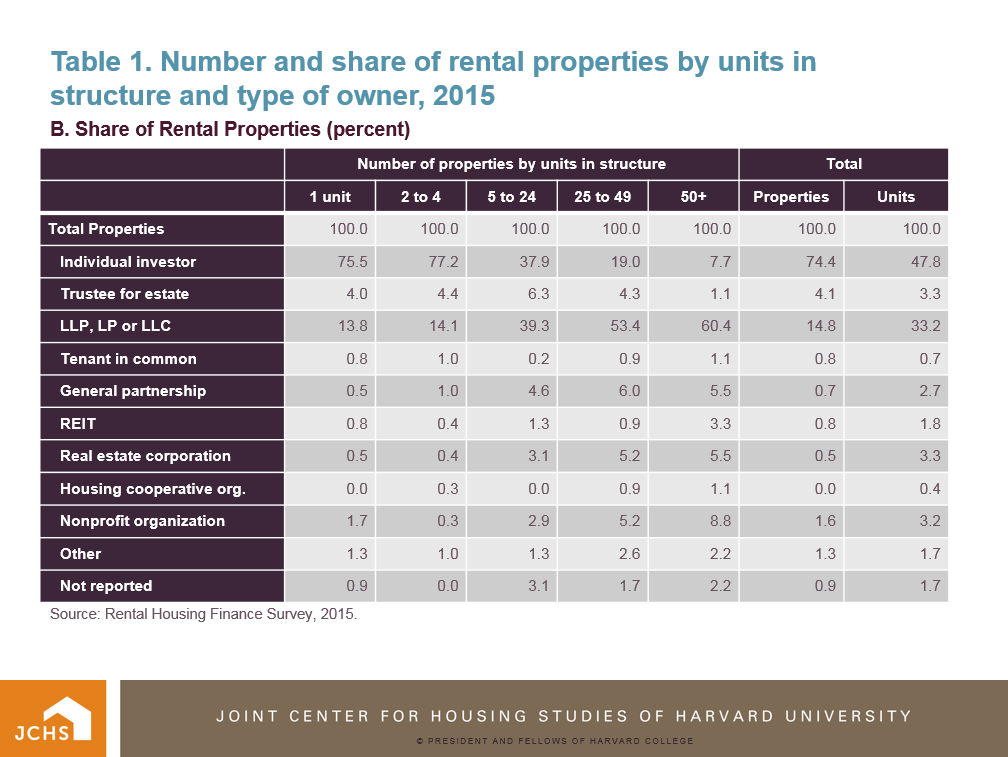

Back in 2017, Harvard’s Joint Center for Housing Studies released a study showing who owns rental properties, based on 2015 data:

76% of SFR rentals are owned by individuals, and another 14% are owned by “LLP, LP or LLC” — most of which will be these smaller “family limited liability companies.” Trusts own another 4% and Nonprofits own 1.7%.

General partnership, REIT, and Real estate corporations owned collectively 1.8% — just beating out Nonprofits.

Maybe the numbers have changed since 2015, but Pew Research’s 2021 study showed that 71.6% of landlords with 1-4 units were individuals, and “businesses” (which surely includes these small family LLCs and family trusts) owned 18.8%. Even with all of the real estate investment from 2020 to 2022, maybe Big Corporate got to 2% of ownership? Maybe 3%?

HF 685 therefore impacts only about 2% of the housing stock that is owned by Big Corporate. If legislators really wanted to do something here instead of merely appearing as if they were doing something, they would have gone after individuals and family LLC’s and left the big corporate entities out. That would have hit almost 90% of the single family rental properties.

The idea that 2% more single family houses coming on the market (to be snapped up by a rich person’s family trust) will do much for housing affordability or help families (other than these landlord families of course) build wealth through homeownership is a joke. And a cruel one.

Detour Into “And” Land; Bad Drafting in Practice

I mentioned above that the “and” is important. The bill doesn’t prohibit big corporations from buying a single family house or building one. It prevents big corporations from buying and subsequently converting that SFR into a rental.

But what does that mean? Lawyers get paid to find loopholes and weaknesses in the language.

If a year passes between buying and converting, is that “subsequently”? What if 30 years pass? 10 years? Five? A month? Three months?

If a big corporation buys a SFR then sells it to a family trust which then converts it into a rental, this prohibition likely doesn’t apply. But what if Big Corporate buys a SFR, renovates it, upgrades it, and then turns it into a rental? There have been numerous steps taken between purchase and rental. Is that “subsequently”?

There’s also the “one rental unit” clause. Presumably, buying a SFR and converting it into a boarding house with each bedroom rented out separately avoids this law altogether. Probably not what the authors had in mind, but… there you go.

This isn’t all that important but I do enjoy finding “legal loopholes” for fun so….

Screws Homeowners, For Little Gain and Muy Corrupcion

What the disappearance of Big Corporate will do is to hurt existing homeowners when they finally go to sell their houses. Even if the ownership percentage is small, the impact of large institutional buyers was large on the price of homes. A family buyer would need to outbid investors, including Big Corporate investors, which meant more money in the seller’s pocket. Now, that dynamic is gone. Homeowners looking to sell in Minnesota will face lower sale prices because a segment of buyers with outsized influence just went poof.

Every single discussion of the negative impact of Big Corporate, whether those are institutional investors or flippers or iBuyers, focuses only on how much such a thing harms buyers. There is never a discussion about how such things benefit sellers. As KRS ONE once said, “Ask yourself homeboy, why is that?”

Of course, the evisceration of private property rights is not a bug but a feature. The bill purports to enforce this prohibition against corporate landlords by seizing these properties and selling them at auction as if the home was foreclosed on for repayment of a mortgage… except that these homes have no mortgage on them as they were bought by big institutions.

It used to be that such a thing would have been considered a taking by the government, subject to compensation. People would be outraged and demand a change. In 2023? Maybe that’s just par for the course and to be expected, because… well… just because.

The avenue of corruption lies in the “exemption” clause:

A corporate entity, real estate developer, or residential building contractor may petition the commissioner for an exemption from paragraph (a). The commissioner may issue an exemption if the entity meets the following criteria:

(1) the exemption would not contradict the purpose of this section; and

(2) the petitioning entity would not have an impact upon the availability of affordable housing.

This is a rather subjective standard. What does and does not contradict the purpose of this law? What is an impact and what is not an impact? The commissioner may or may not determine that an exemption would or would not contradict the purpose, and might or might not decide whether there is an impact or not on affordable housing. I can’t imagine the frequency and amount of campaign contributions, for example, or whether the commissioner’s friends and family might have business relationships with a corporation or a developer would play any role in a determination, can you?

Whither the REALTOR Party?

That politicians who would do anything for a vote and ignore economics is a given. What remains to be seen is whether professional real estate agents and their trade organization who do know the economics of housing would fight stupid laws like this or not… especially since this bill is likely to be popular.

It’s difficult to be seen as defending Black Rock or Invitation Homes. It’s difficult to be defending the wealthy family with 20 rental homes in their family investment trust, while the average working family is struggling to buy one home. But either private property rights mean something to REALTORS, or they do not.

At the same time, REALTORS cannot be seen as merely being handmaidens of the wealthy property owner class. They have to give a damn about all those people (especially younger generations) who cannot afford to buy a home… and the sight of REITs buying their dream home for cash is going to tip people over the edge.

I’m sure the many lobbyists and REALTOR PAC people have great ideas; they should articulate them not just to politicians but to the membership and the public. But in the meantime, here are a few of mine that will be increasingly unrealistic. I imagine all of them to be unrealistic actually, but in the spirit of spurring thought and debate, here we go.

As a longtime fan of the REALTOR Movement who is still inspired by the words of the Preamble, I would love to see the REALTOR Party make one or more of these arguments to policymakers. After all, they know housing; policymakers do not.

1. Soft Cap on SFR Ownership

Instead of loose undefined language combined with a purely subjective exemption process by the commissioner, Minnesota (and other state governments) can simply limit the number of SFR properties one person/company/entity can own.

Four seems like a decent number to me. The vast majority of the 76% of individual investors who own SFR properties for rent are going to own fewer than four investment properties. More than four and you’re in legitimate rich guy territory, and maybe you should consider investing in multifamily apartments instead.

This approach also has the benefit of going after the actual source of competition for SFRs: individual and family investors, not giant corporations and REITs. But by keeping the cap reasonable, you minimize the number of individual and family investors you hurt with this.

Make it a soft cap by allowing a one-for-one increase in the cap for each home rented for affordable housing (which is defined in the bill). So a company can own 10 SFR’s if three are rented to low-to-moderate income renters at below-market rates (original 4 + 3 low income + 3 additional). A family LLC can own 30 SFRs if 13 are rented to low-income households.

This still sucks, and it is still a violation of private property rights, but it might be a compromise that people can live with. Homeowners get hurt by reduction in the buyer pool, but nowhere near as much as if all corporate ownership were banned. Removing the subjective exemption and enforcement process reduces the opportunity for graft and corruption, while providing a hard and fast rule for everyone to easily understand what is and is not allowed, is a major improvement.

2. Eliminate Zoning and Implement School Choice

Less likely but still within striking distance of possible is eliminating single family zoning laws. Minneapolis famously did so in 2018. Of course, further reforms are necessary to spark the kind of housing production Minneapolis needs, but it’s a step forward. Other states like Oregon, California and Maine have also eliminated single family zoning. All three are progressive blue states, like Minnesota. So it isn’t a crazy idea.

Furthermore, school choice is the law in five states: Arkansas, Arizona, Iowa, Utah and West Virginia. Yes, that’s a controversial program, and yes, all five of those states are bright red states versus Minnesota’s deep blue. But perhaps the deal between the Dems and the GOP in the Minnesota legislature is to do both and make both sides happy and unhappy — a sign of a fair bargain.

Combining both drives housing affordability across the board. If you don’t have to buy the million dollar house for your kids to have a top-notch education, then you might choose to buy (or rent) somewhere cheaper. Home prices will tend to flatten as the highs get pulled down, and the lows get pulled up. Furthermore, eliminating single family zoning results in more housing units per acre of land, which increases supply, drops price, and lets the corporations and non-profits play an important role in converting McMansions into four-plexes.

Importantly, you have eliminated no one from the pool of potential buyers and instead of adding on regulation, you are removing regulatory barriers to housing development.

3. Discourage Rentals, Encourage Lending

Let’s get into one that is even less likely to happen.

Impose a surtax on all rental income, while making income from purchase mortgages tax-free.

Minnesota’s income tax tops out at 9.85% as of this writing and there is a 9.8% corporate income tax. Impose a 10% surtax on rental income, which really discourages becoming a landlord (and drives up the cost of rent); at the same time, let the interest income from providing mortgages be tax-free.

The big corporation that was thinking about buying 5,000 SFR’s and turning them into rentals might do some math and realize that it is far better to take that money and provide purchase mortgages to a bunch of buyers. The individual investor might decide not to buy that additional investment property, and invest that money into a Tax Free Mortgage Fund instead, earnings 6% tax-free for 30 years.

A lot of Minnesotans are going to discover that it is indeed cheaper to buy than rent all of a sudden as rents will spike, while every bank and mortgage broker will be calling them to get a mortgage and buy a house. Home prices will likely rise, which will make homeowners and REALTORS happy, but we are also likely to see a real spurt in building activities as builders rush to create more product for mortgages to finance: homes.

If the Minnesota Congressional delegation is able to talk the Federal government into making income from purchase mortgages tax-free… stand back.

4. Total Deregulation

Finally, the ultimate in never-gonna-happen: eliminate all local and state laws and regulations and subsidies on housing.

In a previous post, I talked about Bryan Caplan, economist at George Mason University, who is a proponent of massive and complete deregulation of housing. I posted this sneak peek from a graphic novel he has coming out called Build, Baby, Build: The Science and Ethics of Housing Regulation.

Crazy libertarians like Caplan and me would love to see this happen as we are firm believers in the free market’s ability to solve all problems, even affordable housing and corporations buying up SFRs. But that is probably why it will never happen. Libertarians dream the impossible dream, fight the unbeatable foe, and reach for the unreachable star. Oh well!

Not being crazy libertarian types, you will want practical and pragmatic solutions. I gave you a couple to think on but chances are, you probably have more that are more practical and even more pragmatic. Shout them out. Raise the issue at meeting after meeting. Inform the membership, propose solutions not just behind closed doors but to the public. Stand for private property rights and for practical solutions or for impossible dreams. But stand somewhere and for something.

Let’s leave it there.

-rsh