I think it’s safe to say that I was reeling in a bit of shock and disappointment last quarter, when Zillow abruptly quit the iBuying business. I thought for years that Zillow’s overall strategy made perfect sense, and that becoming the market maker for residential housing was at the center of that strategy.

So I have been looking forward to this earnings call. I figured that Rich Barton and team have to paint some sort of narrative about what Zillow 3.0 — the post-iBuying Zillow — will be. While I am not 100% satisfied with the answers we got from Zillow management, I think we have at least a high-level answer as to what Zillow 3.0 will be.

Turns out, Zillow is going to be Scott Pilgrim and fight the whole world. At the very least, Zillow is going to fight a whole bunch of evil exes. Maybe even current boyfriends.

What Zillow announced is that it more or less plans to:

- Replace the existing central integrator, the real estate agent, with a Housing Super App

- Go after the sole remaining profit centers of real estate brokerages

- Go after extraordinarily powerful companies in title and mortgage

We’ll go into a lot more detail below. This is a very long post, but the subject deserves an in-depth exploration. And honestly, even with some 5,000 words, we’re only going to scratch the surface.

Relevant (?) Numbers, Very Briefly

I’m frankly not even sure the numbers are relevant for our analysis here. But let’s at least review the quarterly and full-year numbers quickly.

Because they are relevant to our discussion, let’s look very briefly at some key numbers. From the Press Release:

- Consolidated Q4 revenue was $3.9 billion, and full-year 2021 revenue was $8.1 billion.

- IMT segment revenue grew 14% year over year to $483 million for Q4, above the $481 million midpoint of the company’s outlook range. Premier Agent revenue grew 13% year over year to $354 million for Q4, as the company continued to execute on making connections between high-intent customers and high-performing agents.

- Homes segment revenue of $3.3 billion for Q4 well exceeded the company’s outlook as the wind-down of iBuying operations progressed faster than anticipated.

- Mortgages segment revenue was $51 million for Q4, at the high-end of the company’s outlook range.

- Consolidated GAAP net loss was $261 million for Q4 and net loss was $528 million for full year 2021.

- Traffic to Zillow Group’s mobile apps and websites in Q4 was 198 million average monthly unique users, roughly flat year over year, which drove 2.3 billion visits during the same period, up 2% year over year. Full year 2021 visits were 10.2 billion, up 6% from the previous year.

- The company exited 2021 with cash and investments of $3.1 billion, down slightly from $3.2 billion at the end of Q3, reflecting the impact of $302 million in share repurchases in December under the current $750 million share repurchase authorization, largely offset by positive cash flow from the IMT segment.

The only comment I want to make on the numbers is that we don’t know the full extent to which the 14% increase in IMT, and the 13% increase in Premier Agent, came from Flex vs. MBP. If a lot of it came from Flex… then I wouldn’t feel so great about it for the simple reason that average home prices went up some 15% in 2021:

Consumer desire for homeownership against persistently low supply of for-sale homes created one of the hottest housing markets in decades in 2021 — and spurred record-breaking home price growth. Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%. Home price growth in 2021 started off at 10% in the first quarter, steadily increasing and ending the year with an increase of 18% for the fourth quarter.

Since Flex charges a referral fee, based on a percentage of the commission, and commissions are based on sold price… if home prices are up 15% and IMT revenues are up 14%… that feels like treading water to me. But as I said, we have no real detail on what percentage of IMT revenues are from Flex vs. MBP.

The Vision: The Housing Super App

Without question, the most important takeaway from the earnings call is Zillow’s vision for the future. Here’s Rich Barton from the Shareholder Letter:

Our mission has been steady, and our vision for Zillow 2.0 remains unchanged. We are moving forward with the strategy to help more high-intent movers find and win their home through digital solutions, first-class partnerships, and easier buying, selling, financing and renting experiences.

To execute on this strategy, we are focused on building the ‘housing super app’ — an integrated digital experience in which Zillow connects all the fragmented pieces of the moving process and brings them together on one transaction platform. We are well-positioned to execute here, given our position in the hearts and minds of consumers today, with more than 3x the number of daily active app users than our closest competitor

What is this “housing super app” you ask? Because I certainly did. From Zillow’s Investor Strategy Presentation, which they released together with this earnings call:

And here’s Rich Barton explaining what this is in the earnings call:

We all know that moving is complicated, time-consuming and full of loops and hoops to jump through in a disjointed and opaque process. Anyone who has been through a move knows how challenging it can be to research, shop, select, finance, appraise, close and have to connect all these separate vendors and spend time taking down information and managing the process yourself. Sometimes you do all of this and still end up losing out on your dream home, especially in this competitive market.

On top of the time and energy we expended on this taxing process, all of these pieces add up to between $26,000 and $40,000 of extra expense on an average priced home. Moving is exhausting and expensive. And to us, it’s painfully clear that customers deserve and control. Our opportunity is to create the housing super app, an integrated digital experience in which Zillow connects all of the fragmented pieces of the moving process and brings them together on one transaction platform, empowering customers with data, a suite of Zillow-owned solutions at their fingertips and a network of best-in-class partners to make it easier for them to move, start to finish. Our customers will be able to do everything within the Zillow ecosystem. That’s the dream we’re building towards. [Emphasis added]

I wanted to expand the quote a bit to provide additional context, which is important.

So Zillow will build the housing super app that will enable customers to “do everything within the Zillow ecosystem.” What does that mean for Zillow 3.0?

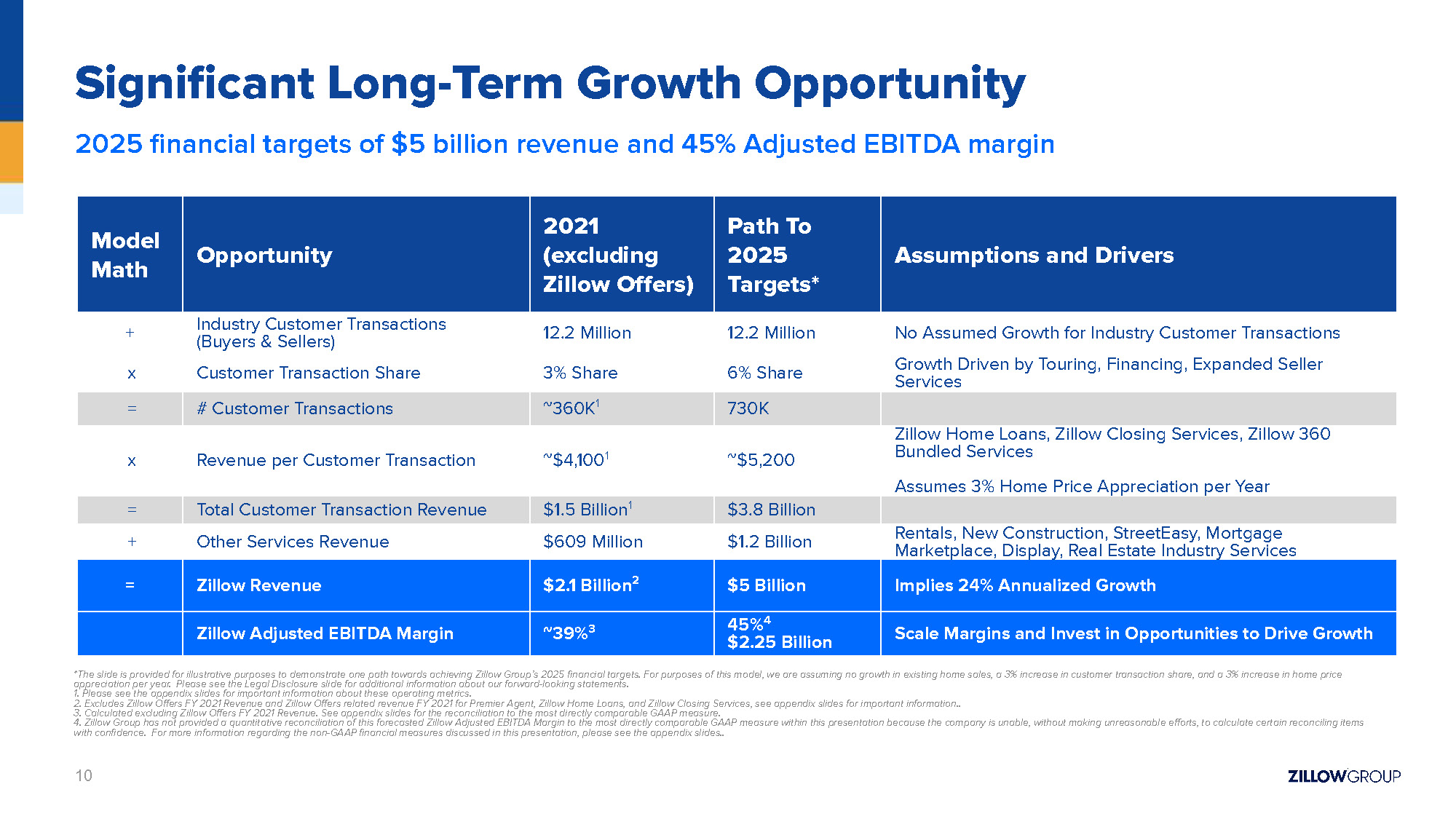

The target has been set: $5 billion in annual revenues, $2.25 billion in Adjusted EBITDA at 45% margins. Most of that growth will come from doubling the “customer transaction share” from 3% of all transactions today to 6% of all transactions in 2025. Plus, Zillow will basically double the “Other Services Revenue” from “Rentals, New Construction, StreetEasy, Mortgage Marketplace, Display, Real Estate Industry Services” from $609 million to $1.2 billion.

It is important to note here that this $5 billion in revenue is not coming from IMT as it exists today. This is coming strictly from ancillary services revenue, plus the “Other Services Revenue.” The $1.9 billion in 2021 IMT revenue is not part of this projection.

Which naturally raises the question of, “So how much of that $1.5 billion in Total Customer Transaction Revenue opportunity in 2021 did Zillow actually capture?” The answer today is about $51 million, which is what Zillow Mortgage brought in. That’s about 0.4% of the Customer Transactions actually doing something with Zillow Home Loans, Zillow Closing Services, etc. So not only does Zillow have to double consumer transaction share from 3% to 6%, they have to go from converting 0.4% of the Transactions to Revenue to converting 100% of them to Revenue to hit their targets. If Zillow manages to convert “merely” 20% (which would be extraordinarily high by industry standards), then its 2025 revenue drops to $760 million plus Rentals, New Construction, etc.

Start Here: Scott Pilgrim Does Ultimately Win

Let’s start with the obvious: Zillow is the most powerful brand in residential real estate. It has everything it needs to win. Rich Barton said so himself:

So why do I feel so good about this? Well, we have an unbelievably solid foundation from which to innovate and a great track record of growth in our core business. No company in our category has a stronger claim to hearts and minds at the top of the funnel, with nearly 200 million unique users flocking to our sites and apps every month. The strength of our brand is unmatched with Zillow searched more on Google than the term for real estate.

Similarly, no other company has our track record of technology innovation in the housing industry. Over the past 15-plus years, we have steadily grown the size and quality of our team of engineers, designers, product managers, data scientists and analysts and many more that make up a formidable investment in R&D, reflecting our belief in the opportunity ahead. In 2021, we 4x-ed our software releases into production versus our releases in 2015, and we are investing in our ability to further accelerate our pace of innovation for customers and for partners.

Plus, let’s not forget the $3.1 billion in cash in the bank, the $1.9 billion a year IMT business throwing off profits at a 40% margin, and a fantastic management team with deep experience in real estate.

So yes, if anyone could do it, Zillow could do it.

Having acknowledged that, I have some questions.

What Will Zillow Do About the Existing Housing Super App?

During the prepared remarks, Rich Barton says:

We know that the size of the prize is large when we become the central integrator, connecting pieces of the fragmented process and turning dreamers into transactors within the Zillow Housing Super App ecosystem.

In residential real estate today, that central integrator already exists. It’s called “the real estate agent.”

I wrote about this back in 2017, when real estate agents freaked out about Zillow entering iBuying. I wrote that maybe some agents are pissed off at Zillow because Zillow Offers would compete against them for getting listings. Then I wrote:

I’d like y’all to meet Blayne Vackar, my Realtor. Since 2011, when I first met him moving to Texas, Blayne has helped me buy a house, sell a house, buy two more houses, and is now working on selling a house for me. That’s five transactions in six years.

When I decided to put my house on the market, I didn’t go to Zillow — even though, as I said, I have a business relationship with them. I didn’t go to HAR.com, even though HAR is dominant here in Houston. I just texted Blayne.

Now, Blayne sorta sucks at post-transaction relationship management — something we’ve talked about in the past. But still, he’s not terrible, and we’ve become friends over the years.

He takes care of me in a transaction. I just got a text last night telling me about landscaping costs to prep my house for sale. He’s handling everything from cleaning to repairs to staging (though I’m not staging this house, as it’s empty) so I don’t have to.

When I’ve got that, why would I bother with anything else? Technology is cool and all, but it doesn’t replace My Realtor anymore than virtual porn could replace my girlfriend.

One of the value propositions of a competent real estate agent today is that he or she will connect pieces of the fragmented process and turn dreamers into transactors. I’ve been in real estate for decades; my wife is a recovering broker. We can do this ourselves if we want to.

But we don’t want to. We would rather hire a competent agent who will do all of that coordination, all of the connection, and take care of shit so we can just fill out forms, send documents along, and have it done for us. This is one reason why mortgage, title, escrow, home inspection, etc. etc. spend so much time and energy and money courting real estate agents. This is why Compass raised hundreds of millions, and then went public. Real estate agents are the central connector today.

Zillow wants to replace that with an app.

I’m not saying it can’t happen, or that it won’t happen. Technology is both powerful and fast-moving. And the trend with AI tools today is to make humans who use AI tools more effective. The Zillow housing super app might simply be a tool in the arsenal of the Zillow Premier Agent, creating a new kind of bionic super agent. So the housing super app won’t replace all agents, just a lot of them.

And yet… consider how this might work.

Stockbrokers and Online Trading Platforms

I think some people will want to point to travel agents, especially because of Barton’s background in Expedia. But the better example might be how stock brokerage was impacted by online platforms like E-Trade.

There have been numerous academic papers written on the topic, but this one is pretty good for the beginner and layman. The authors point out some obvious benefits of online trading for investors: “These benefits include low transaction costs, speed, convenience, boundary spanning abilities, and immediate access to financial information.”

The flipside of this finding is that if online trading did not offer lower transaction costs, speed, convenience and boundary spanning abilities, then investors likely would not have adopted it as they did. Why go to E-Trade if it costs the same as calling your stockbroker at Morgan Stanley? Why bother with TD Ameritrade if it’ll take just as long to confirm a trade?

Which means that whatever housing super app Zillow develops must offer real benefits to buyers and sellers. Is “connect the pieces of the fragmented process” enough of a benefit for the buyer or seller to move away from using the existing central integrator? I kinda doubt it. Wouldn’t the super app have to offer lower transaction costs, speed, convenience, boundary spanning abilities, and immediate access to information? Zillow can probably offer the last; how will it offer the first three without fundamentally altering the way that transactions are done?

One answer might be in line with what Zillow has been saying for years: route more and more business to the top producing agents and teams to improve the consumer experience. The housing super app will just be a powerful tool for Zillow Premier Agents. That could work, and given the professionalism problem in the industry, it is a worthy goal. However, that just feels like an evolution of what Zillow does today, but with real dangers, as we’ll discuss below.

The Last Mile Problem

Another critical issue is that the real estate industry hates Zillow. Reading through the earnings transcript, reading through the Shareholder Letter, it’s as if nobody at Zillow wants to acknowledge this particular gorilla in the living room.

Zillow has Customers and Partners, but no friends. Zillow has no friends despite a decade of trying desperately to make friends. Those in the industry who defend Zillow sound something like this: “Yeah, I’m no fan of Zillow either but look, they have the buyers, so we have to play ball, and I’m just gonna cash these checks.” As Michael Corleone would say, all of Zillow’s people are businessmen.

Try as I might, I can’t think of a single agent or broker or MLS executive or technology vendor who says, “Look man, Zillow is turning on the lights, empowering consumers, and digitizing the transaction! I’m all in!”

With Zillow 2.0, when Zillow pivoted from being a portal to being a player, I thought this was an issue… but not a major one. Haters gonna hate, but everything in real estate revolves around the question of “Who controls the inventory?” And Zillow was on its way to being a real player in controlling the inventory.

With Zillow 3.0 being positioned as the “central integrator” that uses a housing super app to connect consumers to every single thing they could want or need to do anything housing-related… the resentment of the industry becomes a far bigger deal.

Consider a bit of history. When Zillow launched its iBuying business, it did so first as an aggregator, creating a marketplace for investors to connect with homeowners. Zillow then started buying homes directly, using its own money, but used Zillow Premier Agents to do all of the buying and the selling. Then, Zillow became a brokerage and started doing a lot of that itself using licensed agents directly employed by Zillow.

Why? Part of it is the lack of consistent service being provided by Zillow’s partner agents. But let’s not pretend that it had nothing to do with the fact that even their partner agents were and are constantly looking for ways to distance themselves from Zillow. They’ll take the lead, sure, but they’re going to do everything possible to grow that lead themselves, maintain the relationship themselves, and become more important than Zillow in the hearts and minds of those buyers and sellers.

Which means that the problem Zillow 3.0 will need to confront is the last mile problem. Sure, Zillow can get all of the buyers and all of the sellers at the top of the funnel. Zillow can provide them with all kinds of tools and technology. But Zillow cannot deliver the actual service. It takes somebody else to go that “last mile” in the service delivery.

With buyers, Zillow is able to do a lot to control the last mile, because they own the buyer lead and can condition it on the agents providing the last mile doing what Zillow wants them to do.

With sellers, it’s a completely different story.

The Seller Value Proposition Problem

Rich got asked this multiple times during the earnings call, in variously subtle ways that Wall Street analysts have.

Brian Nowak of Morgan Stanley: “Can you just talk to us again, remind us about where are you on monetizing seller leads and how big of a part is that in the long-term targets?”

Brad Erickson, RBC Capital Markets: “On the seller leads that you’re looking to drive, you mentioned some that — you’ve talked about before some of the calls to action that you’re looking to implement on the site. Just curious to hear maybe a bit more about how you might serve to sort of tease out that signal of potential sellers and any maybe early proof points as to how that’s going.”

John Colantuoni, Jefferies: “Given the seller side, it’s been more elusive for Zillow in the past, can you provide any specifics around the products that you’re planning to roll out that will help bolster seller connections?”

The answer that Barton and team provides is somewhat… opaque.

The main thrust appears to be that sellers are buyers, so by helping people dream about a new home, Zillow will get seller leads. Barton talks about Ford advertising the “dream of a new car with the red bow on it” at the Super Bowl rather than advertising “sell your current car to us” and says:

The housing equivalent of that, it holds. People — the inspiration and aspiration of the move is the new place. The greatest seller lead opportunity we have is in helping people dream about the new house, okay? And we have a really fantastic position in that, that we’re already converting into some sell-side business today. Now we also understand that solving this kind of painful but necessary part of the super app, part of the moving process of selling your house is a big deal and having good solves for that with creative new solutions is an important area of innovation, and we are fully embracing that.

I suppose what I’d point out is that Ford is in the business of building new cars. Last I checked, Zillow is not in the homebuilding business. Carvana and CarMax — the automotive equivalent of iBuyers — would absolutely advertise “sell us your car” in a Super Bowl ad. The old Zillow did advertise “sell us your house” and the current Opendoor is running ads telling homeowners, “sell us your house.”

With Zillow 2.0, when Zillow had a home buying operation, one of the most important strategic impacts of that was (and I’ve said this for years) that Zillow now had an incredible value proposition to sellers that made them raise their hand to Zillow and say, “I want an offer.” Cash money tends to be the #1 value proposition to anybody in any transaction. As we’ve discussed for a while, Zillow only bought one out of ten such homes; the rest would be fed as seller leads to its Premier Agent network.

With Zillow 3.0, I guess the idea is that many buyers are also sellers, and Zillow’s new housing super app will somehow make it so compelling for homeowners to raise their hands to tell Zillow that they are looking to sell their home. They’re going to do this despite the fact that just about every homeowner in U.S. and Canada is getting absolutely bombarded with radio ads, billboards, TV ads, online ads, postcards, phone calls, handwritten letters and even agents knocking on their doors saying, “Let me list your home for sale!”

The last mile of seller lead generation is completely dominated by local real estate agents. Zillow is going to replace that with its super app?

Okay. Scott Pilgrim does win in the end, but that’s… a big ask. Meanwhile, Opendoor is straight up offering cash. Those creative new solutions in the super app had best be goddamn mind-blowing to beat out cash money as a value proposition.

Zillow vs. The World Problem

The third issue, and it’s related to the Last Mile Problem, is that Zillow is now making it crystal clear to every company in the industry that Zillow intends to fight them all. Consider this statement from the earnings call:

We had not been focused on the bigger lever, on the bigger opportunity, which is basically distributing a mortgage product directly to our customers and via our Premier Agent partners. In this time period, we are confident that we will be able to develop our fantastic partner network into a distribution network for our mortgage that will then be just integrated into the super app in a way that puts the mortgage in its proper place, which really is kind of a painful but important support stepping stone along the way to the new house. We just wanted to be integrated right into the super app. [Emphasis added]

This makes all kinds of sense, if you don’t know much about the residential real estate industry. If you do, this makes no sense at all. I won’t go too deeply into it, but I do feel that I need to point out three things related to this idea of distributing any ancillary product “via our Premier Agent partners.”

One, each and every productive real estate agent — and lest we forget, Premier Agent partners are overwhelmingly top producers, often team leaders, who are very productive indeed — already has existing relationships with every conceivable ancillary service provider. Mortgage brokers, title reps, escrow companies, home inspectors, general contractors, HVAC guys, etc. etc. all recognize how important the real estate agent is for their businesses. They go out of their way to… ah… “develop and maintain” relationships with top producing agents. One could say a big part of one’s job in ancillary fields is to make agents happy and keep them happy.

For Zillow to replace those relationships — many of which are local, longstanding and often just barely skirt compliance with RESPA (which prohibits all kinds of quid pro quo exchanges) — with some integration into the super app is… well…. this isn’t fighting an evil ex-boyfriend; this is seducing someone away from her current boyfriend. In fact, that requires some Vicomte de Valmont level of seduction skills. I think a lot of Zillow’s salespeople are going to hear variations on “I gotta man” by Positive K.

Seriously. It’s not an easy thing to get an agent to use somebody new for these ancillary services. Not saying Zillow can’t do it; just saying it won’t be easy.

Two, literally every single brokerage in North America either has, is working on, or wants to offer ancillary services to their agents. Take a look at Realogy, HomeServices of America, Howard Hanna, the announced plans from Compass, EXP, and of course every local brokerage of any size whatsoever.

The reason is simple: brokerages in 2022 no longer make money from real estate brokerage. They make money from ancillary services. Brokers have spent decades getting completely crushed on commissions, and have spent that time realizing that they need to operate the brokerage at break-even (at best ~3% profit margins) in order to make money from mortgage, title, escrow, insurance, and other ancillary services.

It’s one thing for Zillow to charge 30% referrals on buyer leads, or to get in the mix with seller leads. It’s one thing for Zillow to have Zillow Mortgage for the iBuyer product, and Zillow Closing Services to save Zillow time and money for buying and selling its owned homes. It’s a whole different story for Zillow to squeeze in mortgage, escrow, and title into sales that their partner agents are doing.

In fact, consider the difficulty of seducing agents away from their own personal relationships with title, mortgage, and escrow people. That means brokerages also have a devil of a time convincing their own agents to use their in-house services. That means to whatever extent that Zillow’s new strategy will seduce agents away from their ancillary services partners, much of it will come from the weak relationships that agents have with their own brokerage’s in-house operations. The wins for Zillow in this area are likely to come at the expense of brokerages.

It is difficult to overstate just how violently negative the reaction from the brokerages will be if Zillow starts messing with their sole remaining profit centers.

Three, these boyfriends who are seeing Zillow flirt with their real estate agent girlfriends… just who might they be? Oh, they’re Big Title like Fidelity and First American? Oh, they’re companies like United Wholesale Mortgage, Quicken Loans, Wells Fargo, JP Morgan Chase, Fairway? I don’t get the vibe that these multi-billion dollar companies are going to just sit back, watch Zillow wine and dine their agents, and go back to sleep. These big companies with enormous budgets might be cautious and conservative, but it does seem to me that they would invest to defend what they already have.

The MLS Corollary

An important element here is how this Zillow vs. The World scenario will play out in the MLS.

Zillow has the best industry relations team in the world, led by Errol Samuelson, who is widely respected and well liked. His team is the best and the largest in the industry. Zillow has spent at least a decade building a good relationships with the MLS community, brick by brick. Even with that team and that track record, however, the world of MLS and REALTOR Associations has always been a bit hostile to Zillow for a variety of reasons.

After Zillow became a brokerage and voluntarily submitted itself to the power of the MLS to dictate things like where listings can be displayed, Zillow took a few gut punches. Most recently, when Zillow announced the ShowingTime acquisition, ShowingTime went from being an essential critical tool of just about every major MLS to something that every major MLS got busy trying to find a replacement for. Competitors to ShowingTime went from big-yawn who-cares companies to some of the hottest companies in proptech, nearly overnight.

I do not believe it is a stretch to think that every MLS that has ShowingTime has at least one person on its Board of Directors wanting to go with someone else or explore options or build their own.

At the time of the announcement, I thought the paranoia was unwarranted. But Zillow was Zillow 2.0 when it acquired ShowingTime, with a focus on becoming a market maker. Zillow 3.0 with its focus on becoming the one-stop shop housing super app is a different animal. A market maker can co-exist with brokerages. A one-stop shop housing super app that eviscerates ancillary revenues cannot.

It is clear from the earnings call that Rich Barton and the team at Zillow are really kind of counting on ShowingTime to be a big driver of the growth from 3% market share to 6%:

ShowingTime’s platform will help convert more shoppers into transactors. In fact, our internal data shows us that the transaction conversion rate of a customer who requests a tour on Zillow is 3x higher than any other connection point our customers have with our partner agents.

So buyers who request a tour with a Premier Agent partner are more likely to buy a home with that partner. We assume this conversion boost from a tour is similar for the industry as a whole, much of which uses ShowingTime, as I said. Yet, we see so much opportunity to increase both the quality and quantity of tours that are facilitated throughout the industry.

Maybe. But I would ask some questions in the Q2 and Q3 earnings calls as to whether that whole “much of the industry uses ShowingTime ” thing remains true a few months from now.

The Grey Goose Event Horizon: Commissions

Finally, while I can go on with additional questions and observations, let me conclude with a simple question that no one bothered to address: what happens to Zillow if something happens to buyer commissions?

I have killed many pixels on these pages and elsewhere simply describing what has been coming out of major civil anti-trust lawsuits against NAR, as well as from the DOJ and the FTC. I’ve detailed what influential think tanks and academics think about commission levels in the United States. With Zillow 3.0, I’m of the opinion that maybe Zillow shareholders should pay closer attention to what’s going on there.

In the Shareholder Letter, Rich Barton laid out a vision:

We know our customers better than we ever have before because we’ve been in the trenches with them, buying and selling thousands of homes. The home buying and selling process continues to be archaic, primarily offline, complicated, time-consuming, stressful, and costly. On top of the time and energy expended on this taxing process, all of these pieces add up to between $26,000 and $40,000 in extra expenses on an average home price of $366,4001. Moving is exhausting and expensive, and to us, it is painfully clear that customers deserve — and demand — more control.

In the footnote to that comment, we get this:

Estimated Cost to Move = $26K-$40K or 7-11% of the average home transaction value of $366,400 per the National Association of REALTORS®. Based on market data, the estimated cost to move includes real estate commissions of 5-6%, mortgage origination fees of 0.5-1%, title insurance premiums of 0.5-1%, escrow fees of 1-2%, and moving costs of 0.2-0.6% for short-distance moves. It does not include other potential costs like closing concessions, inspection, appraisal, dual mortgage payments or renovations. [Emphasis added]

Let me make two points here.

First, it’s fantastic that Barton recognizes the time, energy and the cost of moving. However, most of the cost of moving is obviously coming from the real estate commissions of 5-6%. One might ask at this time exactly where Zillow’s Premier Agent partners get the money to pay Zillow billions of dollars in IMT revenue. The answer is, they get the money largely from buy-side commissions.

If buy-side commission craters thanks to government action, that is an immediate disaster scenario for Zillow 3.0. Talk about the last mile drying up for buyer representation in a big way.

Second, even if whatever the government does to commissions is not dramatic — say it’s something like allowing buyers to capitalize the commission into the mortgage — that still drops the value of a buyer connection from Zillow. Because now, the Premier Agent partner has to spend time and energy and effort convincing the buyer to pay her. That last mile service delivery isn’t going to improve because Premier Agent partners have greater uncertainty about getting paid, is it?

As of this writing, Zillow is without a clear value proposition to sellers. They are developing creative new solutions, but creative new solutions that fall short of straight up cash offers.

That this grey goose event (so named because it is foreseeable, unlike a black swan) is completely unaddressed is something of a gap.

Wrapping Up

This is getting far too long, even for me. So let me wrap up with a final observation.

The Zillow 3.0 story is interesting, even compelling, at the surface level. The idea of Zillow, with its unquestioned dominance in traffic, with all of its technology, its large and impressive engineering team, and all of its money and the cash cow IMT business, will stop being distracted with market making and focus on monetizing its traffic is a strong one. As of this writing, Zillow stock skyrocketed on the earnings report.

Scratch the surface of the Zillow 3.0 vision, however, and all sorts of questions start to emerge.

Replacing the existing central integrator in real estate… or more charitably, reducing the number of central integrators to the small minority who are Zillow Premier Agents… will not be easy. It likely can’t be done without offering a lot more consumer value: lower transaction costs, speed, convenience, and so on.

Becoming a one-stop shop for consumers is the Holy Grail of the industry that everybody is pursuing. Zillow is the strongest company in the industry, so it has the inside track on actually becoming that. But Zillow is going to multiply both the quantity and quality of its enemies, and ramp up the intensity of opposition to Zillow among brokerages.

Getting rid of the single most powerful seller value proposition — cash money — because of the risks involved is fine. But strategically, there ought to be concerns about what’s happening in the regulatory space vis-a-vis buyer commissions as a result.

Finally, I have to note that I write this based solely on what Zillow presented at this earnings call, in this Shareholder Letter, and with this Investor Presentation. They haven’t gone into detail on some of the plans, and the details could change the strategic implications. They are the smartest operators in the business over there at Zillow, so by no means is this DOOOOOMZZ!!! for anybody. Maybe there is no war, and there are just a series of deals with various brokerages, mortgage banks, title companies, and so on.

Maybe there is a war, but in the end, Zillow emerges victorious as Scott Pilgrim did.

I am simply saying it isn’t going to be easy. At all.

-rsh