After the past week, it is rather delightful to be writing about real estate issues for a change, rather than big social questions and difficult issues. Without further ado, let’s get into it.

Mike DelPrete, a consultant and analyst of real estate technology, sent an email to his list today with the title, “iBuyers Turning Into Brokers Turning Into iBuyers.” I would link to it, but I can’t find a public webpage for the email/article, so I’ll merely suggest that you subscribe to his mailing list instead. Update: a reader sent me the link, so go read the whole thing. And maybe still subscribe to his mailing list. 🙂

His thesis is that iBuyers are turning into brokerages, and in turn, brokerages are turning into iBuyers. He thinks that Opendoor and Offerpad announcing changes is the “biggest evolution of the iBuyer business model in four years.” And at the same time, he thinks:

Over time, by adding these new tools to their toolboxes, traditional agents are slowly turning into iBuyers themselves — or at least offering their full range of services. New ideas are not the exclusive domain of start-ups and disruptors; the best ideas are being co-opted by the traditional industry.

Therefore, he concludes:

Ultimately, this new service — which is in the early stages and not fully rolled out — represents a way for iBuyers to make money without having to actually buy houses. After four years and billions of dollars invested into iBuying, it’s a significant adjustment to the core business model.

I respect DelPrete, especially in the iBuyer and portal space, but I think he really missed the boat on this one. iBuyers are not turning into brokers who are also not turning into iBuyers. Frankly, it’s surprising to see DelPrete fall prey to the familiar confusion between iBuyers and flippers, investors, and bait-and-switch lead generators that call themselves iBuyers. But fall prey he did, which proves fatal for his analysis.

So let’s really understand what is going on.

The Source of Confusion: A Rose By Any Other Name…

The basic source of confusion is the naive willingness to take at face value that someone claiming to be an iBuyer is in fact an iBuyer.

Back in December of 2019, I wrote a post called Why Wall Street Consistently Gets iBuyer Wrong. In it, I pointed out that iBuyer is neither a proptech play nor is it a home flipping play: it has always been, is, and will be a consumer experience play. For that matter I can point you to this post from 2018 when Spencer Rascoff was still CEO, where I point out that iBuyers are not house flippers.

Because the industry has responded to iBuyers initially by pooh-pooh’ing them (“You leave so much money on the table!”) and then by doing the wolf-in-sheep’s-clothing thing (“We’re iBuyers too!”), I suppose it is understandable that one might confuse the offerings from traditional incumbents as the same as Zillow Offers.

Some of the former iBuyers are not doing clarity any favors by straight out suggesting that they’re still iBuyers, even when they are anything but. The best example of this comes from Redfin, who claimed out of the gate that they were iBuyers and were committed to iBuying, but ended last quarter with a whimper.

I wrote then that the transformation of Redfin into Realogy with a better website was complete, but even before Q1 results, I wrote this based on the Q4 earnings call:

What we got, however, is a lot of color around how Glenn and his team thinks about iBuyers. And what they think is quite different from what Zillow and Opendoor think, and consciously so. In fact, what Redfin thinks about iBuyer could have come straight from the lips of Ryan Schneider at Realogy, Adam Contos at RE/MAX, or Gary Keller at Keller Williams.

Here’s Glenn during prepared remarks:

We already discussed on our last call the October launch of RedfinNow in a 13th Market, Las Vegas. We don’t expect to add many more until at least the second half of 2020. We’ll use that time to get better at pricing, renovating and selling homes, a process that already started in October, when we shifted the authority to make an offer from the field to a central set of portfolio managers. This will let us be more programmatic about our investment decisions. Our increasing price discipline has led to a decline on offer win rate through the third and fourth quarters of 2019. Homeowners don’t always tell us about competing offers, so we don’t know how often we get outbid by another institutional buyer. But among the people who contact us about a RedfinNow offer more end up selling to RedfinNow than to a competitor. Sometimes this is because we beat out another buyer. Sometimes it’s because another institutional buyer hasn’t bid.

What makes RedfinNow’s year-over-year fourth quarter revenue growth of 359% remarkable is that we improved margins even as our competitors began what could be a destructive price war. The purchase activity of all institutional buyers slowed in the second half. But for the full year, the other major buyers seem to have made more aggressive offers, likely narrowing their average gain on a sale. Redfin is comfortable ceding growth to competitors if we can’t win the home at a price that can be profitable for us. As we’ve emphasized before, our discipline comes from a belief that different economic conditions will favor different ways for consumers to sell their home, making RedfinNow a more appealing choice one quarter and a brokered sale better the next. [Emphasis added]

Based on these two paragraphs, I’m prepared to drop Redfin from the ranks of iBuyers. Redfin is not an iBuyer or a market maker anymore than Keller Williams is. In fact, the evidence is piling up that Redfin is using RedfinNow as just a listing lead generation tool that once in a while lands on a can’t-lose flip deal, which it will jump on like any other flipper.

So yes, it is understandable that DelPrete gets confused about what an iBuyer actually is, and how an iBuyer is different from WeBuyUglyHouses.com or from 8z Select or from HomePartners of America. Surprising, given his intelligence and knowledge and expertise of the space, but understandable.

Opendoor and Offerpad and the Great Pivot

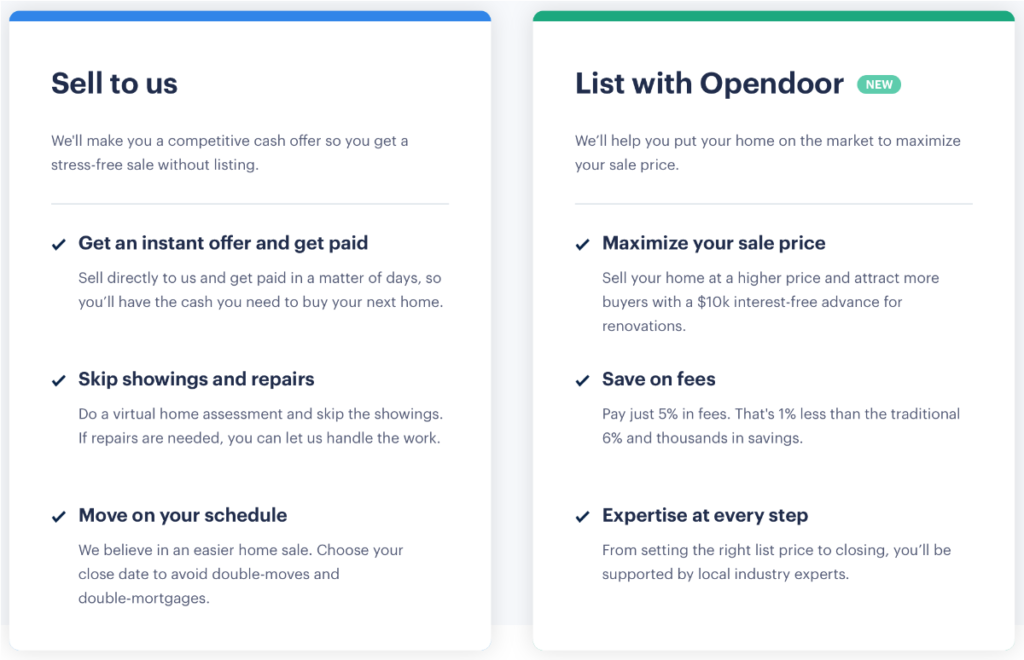

Let’s start with the event that triggered DelPrete’s interpretation: the announcement by Opendoor and Offerpad that they were going to now list homes directly as well as doing the instant offer thing. DelPrete says:

Launching a listing service is an effort to make a sale on every consumer that enters the funnel. It moves from a “take it or leave it” product choice to presenting consumers the illusion of choice (would you like the instant offer or the traditional sale?), a common sales tactic to increase conversion.

Yes… it is true that offering the wolf-in-sheep’s-clothing product choice of “instant offer at 20% discount” or “list for most money possible” is a common sales tactic to increase conversion by traditional brokerages… but that doesn’t mean that Opendoor and Offerpad doing this is an evolution in the iBuyer business model.

What it means is that Opendoor and Offerpad are abandoning the iBuyer business model.

Suppose Tesla were to announce that henceforth, all of its cars would use internal combustion engines. That isn’t an evolution in Tesla’s business model; it’s an abandonment.

Fact is, both Opendoor and Offerpad appear to have gotten caught in a cash crunch that necessitated abandoning the iBuyer model (which requires enormous liquidity and capital) and adopting the traditional brokerage model. Same with Redfin.

Here’s what I wrote about Opendoor’s move when it happened in a post aptly titled “Opendoor Converges to Brokerages“:

Like many other companies, Opendoor is using the pandemic as a convenient public relations narrative to launch something it likely wanted to do anyhow. Quite frankly, that’s smart, because it gives the patina of social responsibility to something that is almost entirely a dollars and cents play.

Since I tend to believe that all things in residential real estate will eventually converge, that Opendoor is adopting the Knock/Flyhomes model is not particularly surprising. It is especially not surprising given that Opendoor has had to kill its hopes and dreams of contending with Zillow to be the Platform for real estate because of the cash crunch.

I think this evolution was inevitable, and COVID simply accelerated things, as it has so often during the last couple of months. What is interesting is what this means for the industry as a whole: Opendoor joins the ranks of tech-enabled companies that are converging towards brokerage, thereby shifting what it means to be a broker (or agent) in housing.

Offerpad was already teetering as a legitimate iBuyer even before COVID, choosing to take on the kind of renovations that Zillow and Opendoor did not, which led me to write them off as a modern day flipper, rather than a true market maker iBuyer.

The way to understand Opendoor and Offerpad’s pivot, then, is to understand them as Opendoor and Offerpad getting pushed out of the iBuyer business entirely because of a cash crisis. It is not “iBuyers become brokerages” and certainly does not warrant the next statement, that brokerages are becoming iBuyers.

Clearing Up the Confusion: Terminology

An interlude in the argument: to clear up all of the confusion, it might help if we defined terms.

When I use the term “iBuyer” I refer to two different business models: the market maker and the bridge buyer. I have written about these in the past, but let me repeat myself:

As I have said in my various writings on iBuyers, there are actually two flavors of iBuyer: the market maker and the bridge loan. Zillow and Opendoor fall under the market maker model: they buy houses for cash from sellers, clean it and paint it, then sell to buyers. Knock and Flyhomes (and other newer entrants) fall under the bridge loan model: they list the seller’s house, get the seller qualified for a mortgage, then pay cash for the seller-now-buyer’s new house, then market and sell the now-vacant home.

Perhaps going forward, we should jettison the now-tarnished term “iBuyer” because I guess just about everybody is an iBuyer as long as they call themselves one? and go with the more precise terms: market maker and bridge buyer.

Both of these remain philosophically in the “iBuyer” camp because they are both concerned about one critical thing: the consumer experience.

Here’s what I wrote in the Wall Street Gets iBuyer Wrong post:

Thing is, iBuying is not about the property at all. It’s about the process.

Using the dating analogy, iBuying isn’t about the person but about the date. Imagine that to go on a date, you need to fill out a dozen government forms, have some health examiner approve the date after consulting a lengthy (and regulated) dating underwriting standards, and spend thousands of dollars on new clothing, new makeup, and maybe plastic surgery… and then the date itself consists of poking and prodding at you to see if you fit their ideal mate standards. Who would date?

Despite some changes in recent years, the process of dating is supposed to be fun and pleasant. It’s called online dating, after all, not online marriage.

With homes, of course it’s unique and not widget-like. No one denies that. Yes, making the wrong choice can be disastrous emotionally and financially. No one denies that. Nobody is suggesting that with iBuyers, people will just go buy houses willy nilly sight-unseen.

What iBuyers are suggesting is that the transaction experience can be improved, not that the homes are widgets. All of the obsession with homes in inventory, prices paid and prices sold, etc. all ignore the plain fact that this new iBuying movement is not about the home/product but the transaction/process.

Because the focus of true iBuyers is on the process and the consumer experience of the transaction, both the market maker and the bridge buyer can be an iBuyer. It’s consumer first, and figure out how to monetize later.

Brokerages and various wolf-in-sheep’s-clothing companies who are offering discounted prices guaranteed to generate a profit are not focused on the process and the consumer experience. So whatever they call themselves, they are not iBuyers, in either model. It’s profit first, then figure out how to hoover the consumer in later.

Which means….

Brokerages Are Not Turning into iBuyers

Once we have a clear understanding of the difference between consumer-first focus and profit-first focus, we can easily see that brokerages are not turning into iBuyers. The line between traditional and disruptor, to use DelPrete’s language, is not only not blurring, it is getting sharper as former iBuyers abandon the business model out of financial necessity and turn themselves into brokerages.

I spoke with brokers and agent teams who offer an instant purchase option to homeowners. They all said that their investors require anywhere from 15% to 30% discount to market value in order to make the numbers work. That’s a far cry from Zillow Offers, which averaged 140bps or 1.4% in the spread between purchase price and ultimate sale price in Q4/2019.

Until and unless brokerages find sources of capital that are not looking for 15-30% spreads, they are not market makers. Period, end of story. Brokerages would need to go find the kind of lenders that Zillow and Opendoor had, with revolvers bearing some fairly strict repurchase conditions based on age of the property, and a pretty sizable interest payment. Without that, brokerages are merely fronts for investors/flippers who require the “buy low, sell high” strategy to make the numbers work.

Again, “making the numbers work” is not the point of market making; improving the consumer experience is. Making the numbers work is entirely secondary; Zillow’s own goal is +/- 200bps of gross margins. As readers know, my own theory is that where Zillow will make the bulk of its profits is in mortgage — a process that COVID has paused for the time being… but it’s merely a pause, and I expect things to continue down that path once the secondary market has calmed down.

Ergo, brokerages are not turning into iBuyers. The line between traditional brokers and agents and the disruptors (frankly, we might be down to one single disruptor) remains bright and not at all blurred.

Strategic Implications

Since DelPrete concluded with strategic implications based on an incorrect analysis, let me also lay out the strategic implications… just based on the correct analysis.

DelPrete writes:

With this move, Opendoor and Offerpad have achieved feature parity with traditional brokerages. They are no longer an option to be considered as an alternative to a traditional listing; they’re a complete solution for any homeowner.

This is only true in the abstract. In reality, Opendoor and Offerpad have certain advantages, and massive disadvantages compared to traditional brokerages.

Their advantages are three:

- Some access to real capital, instead of investor/flipper capital;

- Higher technology development capability (probably);

- W2 employee agents

Their disadvantages are significant, as I laid out in my post about Opendoor’s pivot.

- Opendoor and Offerpad have nowhere near the footprint that traditional brokerages have, and if W2 is the answer, they are far, far behind Redfin, which itself is far, far behind the traditional brokerage incumbents.

- They have precious little institutional experience with being fiduciaries, as opposed to being the counterparty.

- They both have the “you have an ugly baby” problem, which Kelman at Redfin has explained time and again. Telling a homeowner that his house is only worth $300K if Opendoor were to buy it, then trying to convince him that somehow, Opendoor’s agents can sell it for $350K is a very difficult challenge. Redfin was unable to figure it out, no traditional brokerage has figured it out, and there’s no reason to think that Opendoor and Offerpad will figure it out.

- They are far, far behind both Redfin and traditional companies in actual market share, sphere of influence, and traditional lead-generation. And neither have the website that Redfin has, which lets Redfin compete for business, and get to almost 1% market share nationally.

- Neither of them have much institutional experience in actually marketing and selling somebody’s else’s home. It’s easy to do a price reduction on your own properties, all of which are investments. It’s a very different proposition to talk a homeowner into doing a price reduction on the home she raised her kids in, spent tens of thousands remodeling, and believes is a one-of-a-kind peach because of the awesome Game of Thrones inspired mural in the living room.

As a homeowner, if I want to sell my house directly to someone, then I’d want to go with companies with experience and a track record and shop around for price and terms. But if I want to list with someone, why would I list with a company with zero experience doing that when Realogy, RE/Max, Keller Williams, and HomeServices and a hundred boutique brokerages are out there already?

By moving away from the market maker model and towards the bridge buyer model, Opendoor and Offerpad might be able to compete as a new type of brokerage, disrupting not Zillow and not Quicken Loans but Realogy and RE/Max, but we should be cognizant of the very real challenges they face.

What investors need to recognize is that as it comes to the market maker game, there is only one player left: Zillow. As it comes to the bridge buyer game, the field has gotten crowded, and traditional brokerages can move into that arena. The smart ones, like MetroBrokers in Atlanta, are already doing that. Realogy, Re/Max, Redfin, and eXp have yet to make a move — you must decide how to evaluate that lack of action.

What brokerages need to recognize is that strategically speaking, there is no “adjustment to the core business model” of iBuyers. What there is is the pivot away from market making to real estate brokerage by three of the four former market makers: Opendoor, Offerpad, and Redfin. They were forced into the pivot because of cash constraints; Zillow shows no signs of being thus constrained, and the Q2 earnings next month should show that clearly.

Strategically, then, traditional brokerages and agent teams should recognize the competitive advantages and disadvantages of companies like Opendoor and Offerpad as they enter the brokerage realm, especially relative to their own competitive advantages and disadvantages. For example, their W2 model may mean far higher margins, which could translate into market share gains… although, Redfin has had that advantage for 10 years and has grown very modestly indeed. On the flipside, their sphere of influence is laughably tiny.

The thing to really watch out for is not the “change in business model” but the idea that Opendoor and Offerpad could rewrite the MVP (Minimum Value Proposition) for traditional brokerage to include underwriting the purchase of the next home — the bridge buyer model they have both embraced. If that becomes something that consumers demand, then brokerages will have to supply the same — not a bait-and-switch like they have done with market maker model, but a true “list-move-then-sell” program like Flyhomes and now, Opendoor.

Conclusion

Let me summarize my thoughts.

- Opendoor and Offerpad have pivoted away from market making and towards traditional brokerage.

- They have few competitive advantages in that arena, and a whole lot of disadvantages.

- Neither pivot suggests anything about core business models of iBuyer changing; it merely suggests that two companies have abandoned market making, due to cashflow and balance sheet concerns.

- True market making, as well as true bridge buying, are focused not on profit, not on the properties, but on consumer experience. They are focused on the process, not the product. Profit is secondary, at best.

- Brokerages are not adding on those features, thereby blurring the lines between them and true disruptors, because they must be concerned about profitability.

- Until brokers and agents add on actual consumer-experience-first products and services, they are not becoming iBuyers.

- The true strategic implication of Opendoor and Offerpad pivoting is the same one as Redfin pivoting: will these companies redefine the MVP of real estate brokerage to include underwriting purchases? If they do not, then brokerages have nothing to fear. Redfin’s been around for ten years, and it hasn’t broken 1% market share. If they do, then brokerages need to offer the same bridge buyer program in order to remain competitive.

A final thought: let’s say that Zillow, the sole remaining market maker, also chooses to abandon market making and start demanding 30% discounts to fair market value. So exactly zero market makers would remain.

Even that does not “change the business model” of iBuyers. Instead, it means that the market making model has failed. Perhaps it returns later, and perhaps it remains on the ash heap of history. But there is a difference between the two: failure does not mean change.

iBuyers are not turning into brokers who are not turning into iBuyers.

-rsh