Zillow’s big event for its IMT segment — Premier Agents, Rentals and New Construction — just concluded in my (new) hometown of Las Vegas. I attended Tuesday as a member of the press, because when the United States Department of Justice calls you a “trade publication” who am I to disagree? So first, let me thank the PR team at Zillow, and especially Emily who was given the unenviable task of being my minder. You guys were absolutely fantastic.

I think this entire topic deserves far more of an in-depth look, but for now, let me just highlight a couple of quick takes.

For the TL;DR crowd: Zillow will ultimately succeed with Flex, absent major execution errors, but it will need to carry on through the fire and the flames in the short term to do so. Premier Agents will go through the stages of grief: Denial, Anger, Bargaining, Depression and finally, Acceptance. Those who can cut stages short and get to Acceptance sooner rather than later will, accordingly, have advantages over those who can’t let go of the past.

Unlock Confirms My Theories

For me, Unlock was the confirmation of just about everything I’ve written about Zillow’s new direction in the June 2018 Red Dot, which reviewed the Q1/2018 earnings calls. The section for Zillow was subtitled, “The Revolution Will Not Be Televised.”

Then earlier this year, after the Q2 earnings call, I wrote a post titled, “Zillow Raises the Bar in Real Estate, Whether You Like it or Not.”

In it, I pointed out that how Zillow is thinking about its Premier Agent business points to a completely changed relationship between Zillow and the Premier Agent:

This is important because… consider who is doing the selecting. In the old Zillow, the agent was the customer and Zillow was trying to sell you advertising and leads. In the new Zillow, the agent is a vendor, and Zillow picks which vendor it wants the lead to go to based on factors including “quality of the agent.”

This is a big change, and one I’ve talked about for a while now. It is just made plain to see.

I thought that was important because it clearly showed that the new management at Zillow under Rich Barton would pursue the same strategic goals for its IMT business as it did under Spencer Rascoff.

Additional Details from the Flex Workshop

I also attended the Flex workshop where the team laid out some more details about the program. Here’s what I have from my notes:

- Flex is still in “test” mode. It is only available in New Haven, CT, Fort Collins, CO, and Phoenix. Atlanta is scheduled to launch soon. [Edited to clarify Atlanta]

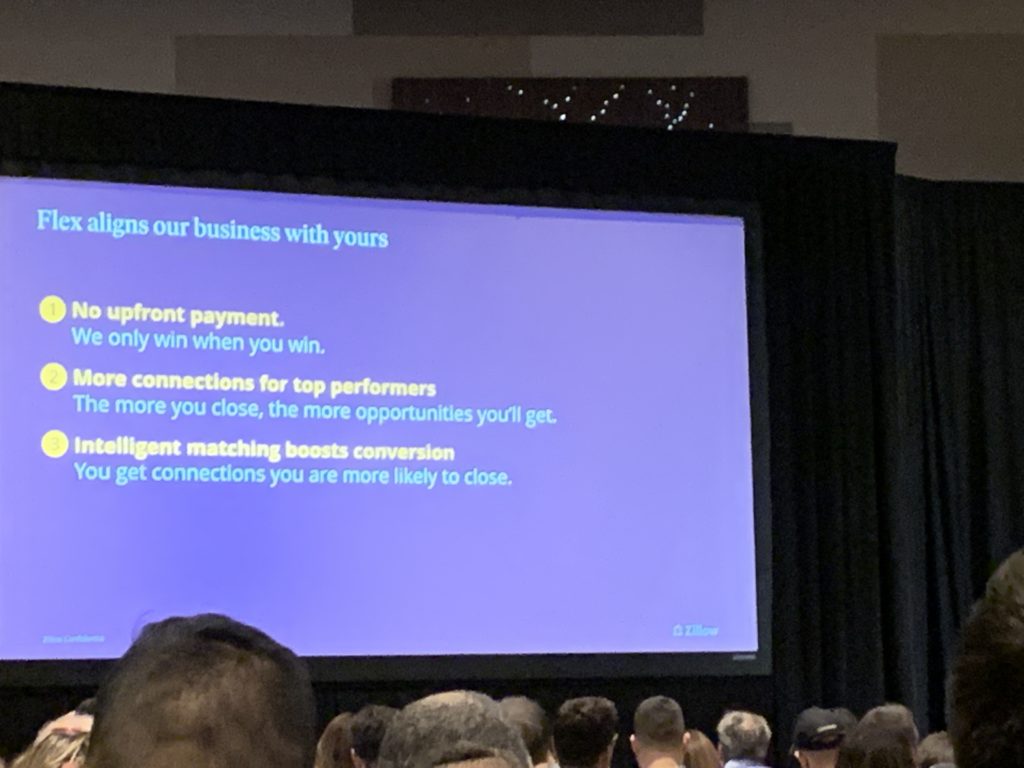

- Pricing is not 100% set, but it ranges from 25% to 35%, with the average coming in around 31-32% according to the presenters from Zillow. There was a lot of pushback from Premier Agents on this.

- Flex will route leads to top performers.

- There will be “intelligent matching” to boost conversion (one assumes this is the manifestation of the Performance Pacing Algorithm Rich Barton mentioned in the Q2 earnings call)

Forgive the quality of the photo, but here’s one slide of interest:

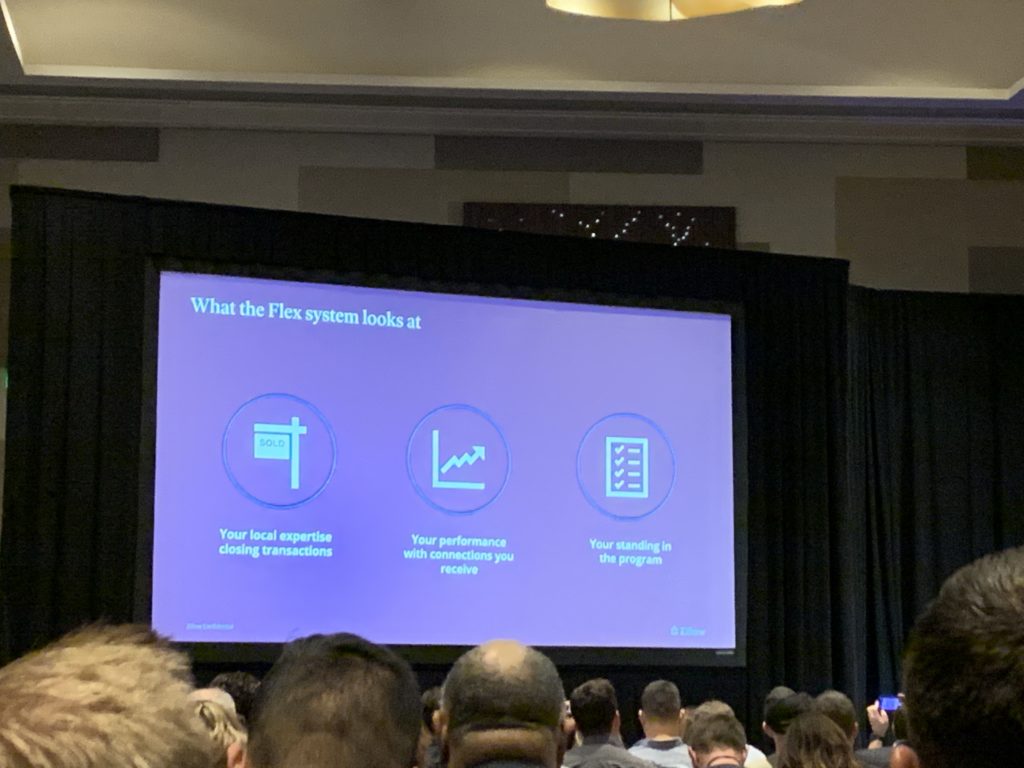

What goes into the intelligent matching? Glad you asked.

Here’s the slide I have for that topic:

Interestingly, the Flex team presenting broke down what goes into “Your standing in the program.” There are two factors:

- Hear from the participating agent weekly via the Premier Agent App

- Pay the success fee on time

Between the two, the first is the one that piques my interest, especially since the Flex team hammered that point over and over again. During the “best practices” segment, the speaker said making weekly updates is huge for getting leads through Flex.

In response to a question about whether Flex will be available only to Premier Agents, the team answered by saying that Flex will be rolled out first to Premier Agents who will have 30 days exclusively, but after that, the grading/algorithms/etc. kick in and those who perform well will receive more Flex leads, while those who do not will get fewer and fewer leads… until one supposed they drop off the program entirely.

Greg Schwartz stepped in and added, “We are here to delight consumers. If you don’t delight consumers, you will get none.”

He softened that by pointing out that while there are some 70 to 80,000 Premier Agents, only about 1,500 Premier Agents were in attendance at Unlock and that each and every one was invited. He suggested that the goal is to have all of Zillow’s partners 10x their businesses, that Zillow is not out to squeeze margins or make things difficult for their good partners, and he wanted all attendees to be “confident in our commitment to you.”

Stages of Grief

The first sign that the current customer base of Premier Agents might not be thrilled and excited about these changes came during Unlock itself. I did not attend Day One sessions, but have heard that during the breakout discussing Zillow Flex, there were plenty of angry Premier Agents protesting the program. I heard that one broker even broke down crying, saying that with these changes, he’d be out of business.

Walking around the Unlock conference afterwards, I heard mixed reactions. Some were happy about Flex, as they would no longer have to front the investment; others were less happy because their per-lead cost would go way up.

Then early Tuesday, a reader sent me this Reddit thread titled, “Zillow Conference Bust.” Now this is one guy and it’s one day after the event. However, I found it interesting because the person who wrote it (Mad_Sam) was upset, but not sounding crazy. Plus, he’s a Premier Agent/Broker who has been spending $400k per year with Zillow. And here’s what he wrote (in case you don’t Reddit):

Just finishing up at the Zillow Unlocked conference. Absolutely astonished how badly leadership has destroyed this company. CEO and entire leadership team made it clear that Zillow is transitioning their business and that their customers are home buyers & sellers, NOT the agents that pay them monthly. We had been battling Zillow recently as they were consistently opening up more market share in our codes and decreasing our exposure if we didn’t pay them more money. Regardless of how the code was actually performing, it was either pay more or they will decrease our leads. If a code is not performing, do we get a rate adjustment in our favor? No, only if it benefits Zillow’s sales team are adjustments made. We were able to hear this from our reps and all the way up to the GM of sales.

They are going to roll out Flex nationally as soon as possible. This allows Zillow to choose who they want to work with while charging up to a 35% fee at closing. The entire room was upset and trying to ask questions during a large breakout session, the poor staff trying to field the questions eventually just walked off stage and said the room was needed for a different session rather than explain why we should pay 2-3x for leads. Oh and the relationship can be charge multiple times if you work with that same buyer or seller again.

Overall tone from conference attendees was relatively uniform, everyone wanted to figure out how to best use Zillow while trying to also understand how to migrate away from them. Zillow is abandoning agents as their customer and they have shown that this is their intention multiple times and multiple ways. Zillow Flex, Zillow Offers and Zillow Home Loans. I can say personally I think it is great they are trying to innovate and grow their company. But throwing out all the agent relationships is going to be their massive mistake that will hit their bottom line quickly.

We left and decreasing our spend by 50% and will decrease it more as our contract run out at the end of the year. Zillow is actively looking to replace us and make you pay for it in the process.

I imagine this thread has gone viral within certain real estate circles by now, because Zaterade is strong in certain segments of the industry. I have no opinion on just how representative or unrepresentative he is of the Premier Agent audience, although he claims that “everyone” he spoke to at the event feels the same way he does.

Denial and Anger… Bargaining is Next

Here’s the thing: it’s silly for Mad_Sam to be upset, but he’s not wrong when he says/realizes that Zillow is abandoning agents as their customer. He’s not wrong when he says that Flex allows Zillow to pick who they want to work with.

That ability to pick who they want to work with is more or less the entire point of the new Zillow, starting in 2018. The seeds of that move, however, were laid as far back as 2015 and earlier. The whole point of Flex and of its predecessors like Premier Agent 4.0 is to allow Zillow to better control the consumer experience so that buyers and sellers keep coming back to Zillow and so that Zillow can protect its hard-earned brand.

So pushback from agents and brokers will not matter in the end, because control of the consumer experience is an all-important, all-consuming strategic priority.

Much of Mad_Sam’s complaint sounds like he’s pissed off that he can’t keep getting more of the good thing he had going. In a comment on the thread, he admits that Zillow has been good for his company: “For the most part we had a positive ROI and did gain many great clients.”

Well, the entire point of advertising, whether on Zillow or on radio or on TV, is to get a positive ROI and gain customers. It appears he got that. If the local radio station wants to raise its rates, or change how it sells radio spots, he can choose to stop advertising, but why be butthurt about it? He’s not entitled to a particular advertising rate, or a particular set of terms, or whatever. You got what you paid for. It sucks that you can’t keep getting what you were once getting, but… allow me to introduce you to a company named Verizon Wireless who is one of the masters of not letting you keep getting what you were once getting.

So really, this looks like classic Anger stage of grief. Mad_Sam had a wonderful thing going for a while. He wishes Zillow would unbreak his heart. But Zillow won’t because Zillow can’t do that and still pursue its strategic requirement to control the consumer experience better.

The Transition from Customer to Vendor

As I wrote above, in the old Zillow, the agent was the customer. Mad_Sam feels like he’s the customer and he’s pissed off that Zillow no longer treats him like one. What he doesn’t yet realize is that in the new Zillow, the agent is a vendor, a channel through which Zillow will distribute services. Zillow can call them partners and reassure them that they are the foundation of success, that buyers and sellers will always want a human being to help them, and that Zillow is committed to them.

But words do not change the reality of the transition. Uber calls its drivers “Partners” as well:

And for Uber and for new Zillow, the real estate agent is the service delivery channel. The agent is a partner of Zillow, in the sense that neither makes any money unless the agent successfully converts the lead and closes the transaction. But as far as the consumer is concerned, he is getting services from Zillow. As far as Zillow is concerned, that buyer or that seller is Zillow’s customer.

This transition is what I have been waiting for since 2012. I have often spoken about the Home Depot Effect, where consumers don’t remember who installed their windows; they just remember that they bought them from Home Depot. It is the right transition to make for Zillow and for any demand aggregation portal in 2019.

However, that transition from customer to vendor will look remarkably similar to the stages of grief for current Premier Agents. Managing that, dealing with emotions, and standing firm in the face of Anger, Bargaining and even Depression will be the challenge for Zillow’s IMT division in 2020 and maybe into 2021.

Why Zillow Will Ultimately Prevail

My thesis is that absent major execution errors, Zillow will go through a firestorm of controversy as existing Premier Agents go through the stages of grief: Denial, Anger, Bargaining, Depression and Acceptance.

It won’t be pleasant, and if you’re in the investment world, the Zillow bears might look like they’ve been right all along. But ultimately, I find myself remaining more of a Zillow bull than a Zillow bear. Why?

When all of the sturm und drang is done, at the end of the day, Zillow has the consumer. Zillow has the leads. And as Offers becomes more and more important, Zillow will have incredibly valuable leads that a real estate agent cannot source on his own: the thousands upon thousands of Zillow’s own transactions.

For every Mad_Sam who wants to take his ball and go home, because he’s giving up 35% of the commission, there may be ten others who want the 65% they would not have gotten otherwise. Even if that ratio is reversed, so for every ten Mad_Sams who cut off Premier Agent, there is one who wants the 65% he would not have had otherwise, it will work out for Zillow in the end. Because once that one who has reached Acceptance stage works the flood of online leads from Zillow, he will grow at the expense of all those who chose to go home instead.

I think we might see some short-term pain in the IMT business, but as more and more brokers and agents start to reach the Acceptance stage, we should see the trend stabilize and then reverse.

In the long run, the Zillow Offers business will be the future of home buying and selling in America. Market makers offer far too much convenience and value to be otherwise. Whether Zillow is the company to do it, or someone else, the market maker model is the longterm future. I remain convinced of that just like the advent of the internal combustion engine meant the end of the horse-and-buggy.

As long as Zillow has the consumer, it cannot help but prevail absent major execution errors.

Longer Term, More Subtle Issue: Headcount-Dependent Institutions

Having said that, there is one longer term issue here for Zillow and for the industry. Let us assume that Flex will ultimately succeed after a period of pain and turmoil, because as long as Zillow has the consumer, it will prevail.

He That Hath, Gets

The way that Flex is structured, because it has to be structured this way, inevitably leads to concentration of power into the few.

There are and will be agents and teams who will embrace the Flex model. They will setup the necessary infrastructure, staff up, hire more administrative staff, institute their own reporting requirements so they can report back to Zillow, etc. etc. They are going to be more successful in converting and closing and in Greg’s words, “delighting consumers.”

Those agents will be routed more and more of Zillow’s leads. Their market share will grow, their revenues will grow, so they’ll hire more agents, hire more staff, and as Saints fans say, Laissez les bon temps roulez!

The more you play out the “lead volume depends on performance” the more it becomes clear that we will eventually end up with a few super agents, few super teams who dominate their local markets in ways we have not ever seen in real estate.

In a real way, this is good for consumers. It’s good for the industry. It raises the bar on agent expertise, customer service, performance, and so on. The industry is headed that way with or without Zillow.

Having Fewer Better Agents Hurts Headcount-Dependent Models

But that future threatens brokerages, MLSs and Associations who have a headcount-dependent business model.

Think about eXp Realty, Re/MAX, Realty One Group, HomeSmart and others who are explicitly dependent on headcount. Think about traditional brokerages with their split-based revenue model, under which the company makes less profit from more productive agents: Realogy, HomeServices of America, Keller Williams, etc. Think about MLS and REALTOR Associations who depend on dues and fees from all of the agents, not just the productive ones.

All of these institutions will face even greater margin pressure and lower fee revenues if He That Hath, Gets gets ramped up to the max.

I can say with a fair amount of confidence that none of them are ready for the transition. I suspect we could see the cycle of grief from these institutions as well.

But again, as long as Zillow has the consumer, it will prevail. The levers that even those large institutions can pull are few in number, and carry real dangers from legal and regulatory angles if they should pull them.

Nonetheless, in the short term, Zillow will need to work hard to convince a lot of people, some of whom don’t really want to be convinced. Faster to Acceptance, the better for everyone.

I think the industry will need to change and move away from the headcount-based models of the past, and there is some time left for companies to do that, but… it’s not easy to convince people to let go of the past, especially when the past was so good for them.

So, short term pain and angst, denial, anger, then bargaining. Some agents and brokers will get depressed as the cycle progresses. Eventually, we’ll get to Acceptance and a new equilibrium. By then, the long term vision of market makers transforming the entire transaction experience should be well into the mainstream.

Interesting times we live in.

-rsh

1 thought on “[VIP] Zillow Unlock Event: Stages of Grief”

“Interesting times we live in.”

Indeed.

Comments are closed.