As a former Dungeon Master all through junior high school and part of high school, I found it absolutely thrilling that Glenn Kelman, CEO of Redfin, used the phrase in the Q2 earnings call. Thank you Glenn for making all of us former (and present day) nerds feel a little bit better about our misspent youth. It makes me feel better about knowing far too much about the Melnibonean and Egyptian pantheons as a 15 year old while knowing far too little about girls.

But “Delayed Blast Fireball” also serves as a neat theme for this earnings call, or at least this analysis of Redfin’s Q2 earnings results, because I don’t feel like I can really put things into context without hearing from both Realogy and Zillow. Both of them report next week, so I think we can get a clearer picture after that. I may have to put my overall thoughts together after all have reported.

In the meantime, however, there are some interesting things to come out of Redfin’s Q2 earnings. It turns out, they lead to more questions… which may be answered or at least clarified after next week… but we can dig into some stuff. We just can’t dig into all the stuff because, well, delayed blast fireball, y’all.

Let’s get into it.

The Numbers

We begin, as we always do, with the numbers.

There’s a lot of good news in these numbers. Revenues are up almost 40% YOY, although a lot of that is in the Redfin Now iBuyer segment, which inflates revenue numbers quite a bit. But the core brokerage business revenues also grew by almost 18% (I generally look only at the actual brokerage business of Redfin’s, leaving the referral-based Partner business to the side, as that gets to the heart of the issues with brokerage.)

The growth in the iBuyer business by over 340%, combined with Glenn Kelman reiterating the commitment to the business despite the news about the partnership with Opendoor (which I took as a fairly large negative), is all kinds of good news as well. I’ll be talking far more about that below.

In Key Metrics, growing the website traffic by over 27% to a rock-solid 36.6 million monthly uniques deserves real credit, and the 20% increase in brokerage transactions — which led to U.S. market share by value going up by over 13% to 0.94% — were also very, very good. And agent productivity was up from 9.2 transactions per Lead Agent to 9.7 transactions per Lead Agent, a 5.4% increase YOY.

So that’s all great news for Redfin.

The Not So Great News

But there are some numbers that continue to make me scratch my head. I don’t quite know what to make of them.

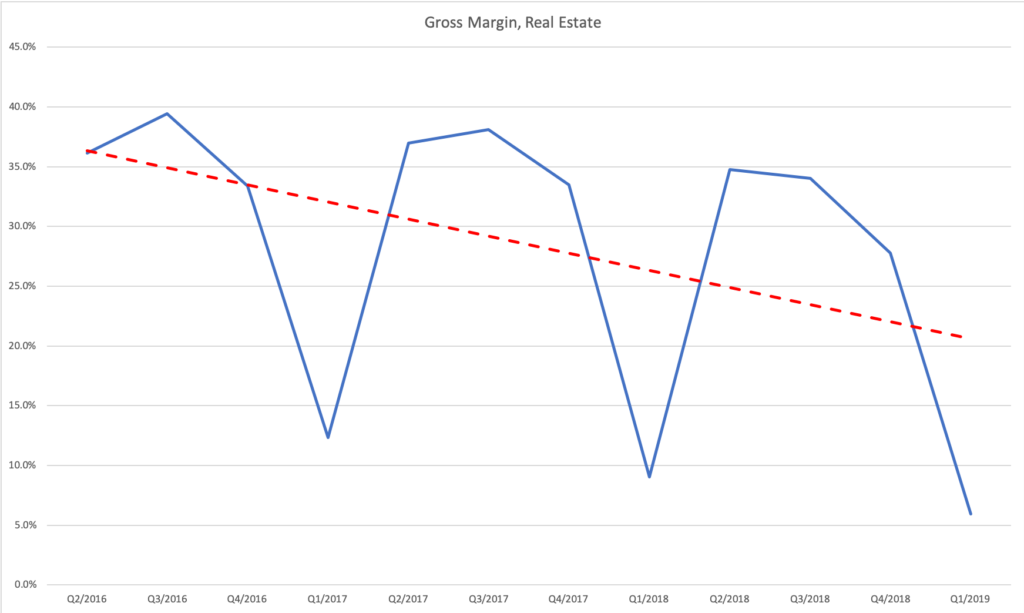

The fact that gross margins in the core Real Estate Services dropped by 260bps from 34.8% to 32.2% YOY is more than a little troubling. The fact that the gross margins for Properties (Redfin Now) dropped by more than double, from -1.1% to -2.5% is all kinds of troubling, at least to me.

The comparison I can’t help shake, even if it is a bit unfair, is that Zillow launched Zillow Flex in September of last year and it is expanding the program this year. Multiple reports from brokers and agents in the field say that the referral fee for Flex is 35%. That’s higher than the gross margin figures for Redfin’s Real Estate Services. Obviously, we’re comparing apples to oranges… actually, are we? I mean, at the end of the day, we’re talking about money left to a company out of an agent’s commissions. From all appearances, Zillow’s 35% is going to be mostly profit as all Zillow is doing is sending a lead to a Premier Agent who promises to pay upon a successful closing. Redfin has to move heaven and earth and do tours and contracts and so on and so forth for its 32.2%?

Yes, compared to traditional brokerages like Realogy or Compass or HomeServices of America, Redfin is killing it with 32.2% gross profit margins (somewhat equivalent to Retained Company Dollar margins, which hovers around 15% for the brokerage industry in North America)… but is that truly the correct comparison in 2019? I don’t know anymore.

But perhaps most troubling is the fact that while agent productivity was up, profitability suffered. I just can’t really understand that. Transactions, volume, and revenue per Lead Agent were all up, but gross profit per lead agent went down by 4.5%?

Because Glenn Kelman kept mentioning how one key driver of growth for Redfin was website traffic, I even put together some numbers on that, looking at transactions, revenue, and gross profit per 1,000 unique visitors. Those numbers are down YOY. What’s more, the trend of those numbers do not look great.

In Q2/2016, those metrics looked like this:

- Transactions per 1,000 Unique Monthly Visitor: 0.44

- Revenue per 1,000 Unique Monthly Visitor: $4.19

- Gross profit per 1,000 Unique Monthly Visitor: $1.61

So after more than doubling the traffic in two years, from just over 17 million monthly uniques to 36 million, the conversion metrics are all down? What explains that?

The Earnings Call: Explanations and Clarifications

Part of the explanation, it appears, is the changes in macro conditions. Basically, buyers are getting priced out of homes and getting frustrated. So they’re wasting Redfin agents’ time touring homes that they then can’t afford to buy, which means wasting Redfin’s money.

Here’s Chris Nielsen, CFO, from the call:

So on the gross margin line, if you’re looking at the second quarter, the biggest headwind was related to home touring and field costs. And the way to think about that is that we do have a lot of top of the funnel customer demand, people who are interested in particular in purchasing homes, that has us incurring an expense, the tour of those customers through homes. And as Glenn mentioned on the call, we’re still not seeing the kind of close rate improvement we would like over time. So we’re incurring the expense of not getting all of the revenue that we would like to over time. And so that’s the biggest, single headwind that we have in the second quarter as it relates to gross margin, specifically in the Real Estate Services portion of the business.

Glenn then adds additional color:

And I just want to add that there’s two components for that. And Chris has described the main one, which is that it’s harder for people to buy a house, they have to see more properties than they did before and some of them get turned off by the high prices. I think also when you have some acceleration and demand, you’re paying it forward, where you’re paying more for tours one quarter and hoping it closes in the other quarter, but we want to temper some of those expectations around how many closes we’ll get, usually we’re very happy to pay high touring cost because those chickens are going to come home to route. It is just that every year we are seeing it gets harder and harder especially in coastal cities for people to pull the trigger. [Emphasis added]

This is hardly Redfin’s fault. It is a wider general problem with American society and American economy, particularly in and around the high-expense urban metro areas where Redfin is concentrated. But that doesn’t change the fact that Redfin keeps growing revenue numbers, while its profitability numbers continue to decline.

What exactly is the answer to this structural defect in the housing market?

The short answer appears to be that there is no answer, other than “work harder.” Glenn was asked for more color on where he thought Redfin was in terms of conversion rates, agent efficiency, etc. and here’s his response:

I think we are in the middle of it. I wish we were at the end of it, but in all candor this is a problem we have been working on for a long time. It affects everyone in the industry. How take someone off a website, click the button and deliver them into the right home, six months later efficiently, has just become a challenge of our times. And we’re much better at it we think than anyone else. But we still need to get even better, because the consumer is changing over the past few years. She’s much more fickle, more worried about prices, struggling harder to be able to buy the home, but also just more casual about ordering a service where you don’t have to pay to get a real estate agent to show up.

So, I think we are going to be building significant new systems over the next year and half to make that better that there is some opportunity for leverage in 2020, you’ve already seen a little bit here, up to 6% productivity increase. But already thinking about 2021, 2022, it’s a long-haul [baby] and I’m really confident that we’re going to make progress on this, but I don’t want you expect an overnight miracle.

I think two thoughts here, at the same time, because consistency is the hobgoblin of little minds.

One, this is classic (and fantastic) Glenn Kelman — transparent and courageous and optimistic and joykilling all at the same time. He rightly points out the difficulty of converting a web lead to a customer, then says Redfin is better at it than anybody else, but that the consumer is getting harder to convert, then says Redfin is going to be “building significant new systems” over the next 18 months, but ends on “don’t expect an overnight miracle.” This is great leadership in difficult times where there are no clear answers. But on the other hand….

Two, great leadership or not, Redfin has no answers. We will see what these significant new systems are, but if we’re looking to 2021 and 2022 and it’s a long-haul [baby] and so on… then I can’t help but feel that Redfin doesn’t really know how to deal with the problem of growing revenues with declining profitability. Work hard! is an answer, and it’s not a bad answer, especially when you think your team is the best out there. But it really isn’t a strategy or a plan either.

There was (and still is, at least according to the earnings call) a strategy out of this morass: a combination of new products/services from Redfin Now to Redfin Direct to Redfin Direct Access. Let’s turn to those next.

Redfin Now, Direct, Direct Access

By far the most interesting part of the call for yours truly was when Glenn and Chris talked about the non-core business of Redfin Now (iBuyer), Redfin Direct (unrepresented buyers), and Redfin Direct Access. This last item is a new experiment in which Redfin is more or less copying Opendoor’s app-based self-service home tours. Rather than needing a Redfin agent, a potential buyer can use the Redfin app, verify his identity, and unlock the doors. It launched in San Diego as a pilot, and early signs are promising.

These three, and the combination of these three, might represent a way out from the morass. Let’s delve in.

Redfin Now

Given that I wondered whether Redfin had surrendered the iBuyer business to Opendoor with its partnership, I found this section of the prepared remarks extremely interesting indeed:

Some of us whether Redfin still plans compete all out with Opendoor in markets where we overlap. The answer is yes. For years to come, we plan to compete with Opendoor and we remain partners. There’s ample precedent to this, as Redfin has referred brokerage customers to partner agents in competing firms for more than a decade, generating the referral fees that constitute 5% of this quarter’s revenue from real estate services. We send homebuyers to other lenders where Redfin mortgage doesn’t have the best loans for their needs.

…

Even when RedfinNow expands to nearly every Opendoor market in the U.S., there will be times when we don’t have the money or staff to buy and sell another home, and we hope a partner will take our place.

And then later on, during the Q&A, we get this:

So first of all, the Opendoor partnership is not a replacement for RedfinNow in any market. And the reason is, is because there’s too much demand for that business, to let us outsource it to anyone else. We want to understand it better. We want to own that inventory. We want to be responsible for selling it. We have 14 years of history selling homes better than anyone else. We think we can build a better marketplace for those listings, if we own those listings.

So there’s plenty of good, bad between those two companies. We really like one another. And we know that we’re going to need one another for a long time to come. But we’ve got to be in this properties business. And we’re making a long-term commitment too to that business because it’s so strategic and because it works so well with all the pieces of the puzzle.

That pretty much definitively answers my question, doesn’t it? I guess I was dead wrong when I thought that there was no way that Eric Wu and Opendoor would do a sucker deal. But apparently, that is exactly what they did.

Or… maybe not. Because if the Opendoor partnership really is what Glenn says it is — like the Partner program under which Redfin sends leads that it does not want to or lacks the capacity to work itself to other brokerages in exchange for a referral fee — then I see no earthly reason why Redfin would not also partner with Zillow Offers and with Offerpad and anybody else who would pay a referral to Redfin. As far as I know, Redfin does not discriminate against agents belonging to any particular brokerage in its brokerage Partner program; it’s just extra income from leads Redfin itself can’t work. Why would it be different with iBuyer leads?

In fact, I could argue, based on the analysis I just concluded about Zillow, Opendoor and Offerpad in Phoenix, that Zillow might make a far better partner than Opendoor for Redfin’s extra leads.

- Zillow’s average purchase price is more than $51K more than Opendoor’s average purchase price. The buy box for Zillow goes from a low of $112K to a high of $587K, while the buy box for Opendoor goes from a low of $51K to a high of $480K — a difference of almost $100K on the upper end. If Redfin wants to pass on leads that it doesn’t want to work, presumably the higher buy box of Zillow Offers would be a better fit.

- From the data we have, Zillow Offers puts more money in the seller’s pocket than does Opendoor: its spread on the purchase and sale is a mere 1.2%, while Opendoor’s is more than double, at 3.5%. Given the culture at Redfin of saving consumers money, maximizing the net for the seller (see, e.g., Redfin Direct), and so on, wouldn’t Zillow be a better partner?

Since I judge the likelihood of a Zillow-Redfin partnership on iBuyers to be on par with [nerd alert] rolling up a Fighter/Mage/Cleric with 18 Charisma… I rather think there’s more to the partnership than just another example of Redfin sending leads to competitors. I could be wrong; I was apparently wrong once already, so… you decide.

But I say, time will tell. In fact, this is one area where I have to wait for Zillow’s Q2 earnings before evaluating it fully. Why?

Because as Glenn says, Redfin has 14 years of history of “selling homes better than anyone else.” Fine, but Properties gross margin was minus 2.5%, down 140 bps YOY, “primarily due to an increase in personnel costs.” Well, it isn’t as if Zillow isn’t hiring like mad too for its Zillow Offers business. In Q1, I thought it was significant that Zillow Homes posted gross margins of 4.7% while Redfin Properties posted gross margins of minus 7.6%. Let’s see what it posts in Q2, and what kind of increase in personnel costs it has to report.

In my judgment, Redfin can lose to Zillow in website traffic, lead routing, referral business, even mortgage and title. It simply cannot lose to Zillow in buying and selling homes, not with its 14 years of history and boots on the ground and local data and local knowledge. It just can’t.

So Delayed Blast Fireball.

Redfin Direct

We got a far longer, far better explanation of Redfin Direct and how it’s working so far. Basically, Redfin expanded Direct to Northern Virginia and Redfin plans to expand Direct in the second half of the year. It’s apparently generating both consumer demand as well as reasonable offers. Glenn said:

While we expected many of the Direct offers to be ludicrous or half-assed, the Direct offers have in fact been more likely than our brokerage customers offers to be cash offers with no contingencies. Most Direct offers are within 5% of the asking price.

Redfin’s experience with its own offer process, its in-house database on things like average number of days for an inspection on a successful offer, and other local data is what makes Redfin Direct possible. Consumers can now access the wealth of data that Redfin has through the Direct program, and once Redfin is done improving it, making it easier to use, it will be a significant program. Glenn hopes to be able to sell 10% of Redfin’s listings via Direct in time.

This is, as you can imagine, rather significant.

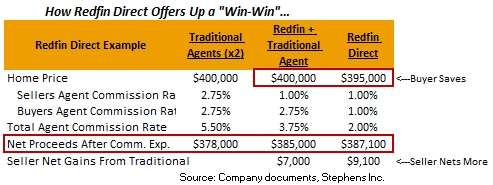

John Campbell of Stephens, Inc. called out Redfin Direct in his note as one reason to be bullish on Redfin:

As we have highlighted in past notes, we believe that the Company’s Redfin Direct business stands out as one of the most compelling LT opportunities yet we feel that it is still underestimated by most investors.

In our view, Redfin Direct is likely to gain better appreciation over the NT as some better understand its LT margin potential. As a refresher, with Redfin Direct, the Company allows potential home buyers to place direct offers, without buyer agent representation, on its website for Redfin-listed homes (where RDFN is the selling agent). RDFN has tools on its site that allow for a standardized contract along with documents that help guide buyers along the bidding process.

This is a unique offering as: 1) it paves the way for lower selling commissions (RDFN charges 1% on the sell side and 1% for the buyer so a 2% all-in commission vs. a typical 3.5%-4% when using RDFN + traditional agents on the other side or a 5%-6% fee for using traditional agents on both sides) and 2) it allows buyers to act quick and potentially offer a slightly lower price while still giving the seller higher net proceeds than higher priced offers coming from buyers that are represented by traditional agents. We believe that this is more easily grasped in the scenario below.

That’s some solid endorsement right there. I find myself agreeing with Campbell more or less entirely. The best thing about Direct, as comes out in the exchange between Campbell and Kelman, is that it is far more scalable than Redfin’s core business:

Sure, we think we can expand this business much more quickly than other businesses, because we don’t have to hire people to do it. This is technology that can easily scale across the country. We do have to train the system to understand the vagaries of different markets because we have different data sets and different offer forms about whether to include this contingency or that contingency, but we can scale it pretty fast.

More self-service and more automation = better margins for Redfin. So that’s one way out of the morass of rising revenues and declining profitability.

The Combo Platter

One of the more intriguing hints from the call came and went without any of the analysts asking about it. It was when Glenn said in his prepared remarks that Redfin plans to have all three new services — Redfin Now, Redfin Direct, and Redfin Direct Access — in the same market in Q3. The combo platter, together with Redfin’s core brokerage business.

I’m almost 100% certain that we won’t know too much about the shape of brokerage from just Q3; it will take longer. But the combination is intriguing if you start to look down the road a bit.

1% Listing Fee brings in listing inquiries, and a Redfin agent can present the seller with both a Redfin Now offer and a CMA to list the property with Redfin. Once listed, Redfin can bring in buyers through the website, and some of them are going to make Direct offers, saving themselves and the seller a bunch of money, as John Campbell pointed out above. And Redfin won’t have to show those houses, because Direct Access lets the buyer tour the home with an app, instead of having to take up a Redfin Showing Agent’s time. That leads to higher margins for Redfin.

It is a wonderful story, if it all comes together. And it makes life that much more difficult for traditional brokers and agents. I think it makes life difficult for the MLS as well, but I’ll need to pull those threads together in more detail.

A Note on The Darkness… Not So Much, Yet

Since I spent an entire Red Dot on Redfin’s plan to spend up to $40 million brand advertising, and how that would bring the darkness to the industry, I feel it would be irresponsible to not at least touch on the news that Redfin won’t be bringing the darkness just yet. I was wrong, at least insofar as timing and impact.

The impact so far in 2019 from the mass media brand advertising has been… well… muted. As Glenn put it, the ads have been effective in raising awareness that Redfin exists, but only “somewhat effective” at driving sales. And Redfin saw smaller than expected gains in those markets that had never seen advertising; in fact, unaided awareness that Redfin exists and is a brokerage was stuck at 4% in those markets.

But brand advertising is the longest of long games, so Redfin will continue mass media advertising in 2020 and beyond, but doesn’t sounds like they plan on doubling down on the spend at least today. There will be no offline advertising in the second half of 2019, for example.

It may be, as Glenn suggested, that the media spend will need some sexy new messaging around new products like Redfin Direct to have real impact. We shall see.

In Closing…

This is getting long, so let me summarize, especially since I think I have to revisit the Redfin story after next week. My overall take is that Redfin is continuing to show impressive growth at the top, with traffic and revenues. But the profitability story is worrisome, as it continues a downward trend that has been going on for a while now.

This was from the Q1 earnings:

Given that Q2’s margins were lower YOY, the trendline continues to point downwards. That should be of concern to Redfin and its investors.

The vocal commitment to Redfin Now, as well as clarification of the partnership with Opendoor, is good news for Redfin and Redfin bulls. That may be the most important piece of the longterm strategic puzzle, and Glenn Kelman said as much. So it’s good to see that Redfin plans to stay in that game.

But as I said from the start, I really can’t draw any real conclusions from Redfin’s results just yet. I think we need to see how Realogy and Zillow’s numbers and results come in first. I suspect that Redfin’s results will be far more heartening than Realogy’s, but Zillow’s results (particularly Zillow Offers) will be the more important one to see.

So take away what you will, but join me in holding our collective breaths for next week’s earnings festivities.

-rsh

3 thoughts on “[VIP] Redfin Q2/2019 Earnings Results: Delayed Blast Fireball”

A balanced and fair analysis. I agree with most, BUT you left out two very important points.

#1. Future guidance –

CFO (Chris Neilson)

“We don’t typically provide guidance on gross margin components, because those are subject to a variety of business and market factors, but we wanted to comment to what we expect for Real Estate Services gross margin in third quarter 2019, given the headwinds we’ve seen so far this year.

We anticipate that agent productivity will continue to increase year-over-year in the third quarter. We believe, however, the third quarter real estate gross margin will be down slightly to flat year-over-year, given we’re seeing strong touring and other customer activity that may not pull through to revenue during the quarter”

Redfin gives conservative guidance & Chris states gross margins will be down slightly to flat year over year in Q3. That’s a positive for shareholders with a Q3 revenue guidance of 59-67% growth y/y.

#2. Zillow using EBITDA for Zillow Offers. I’m not being accusatory, BUT many other analysts including Brad Safalow have explained in much more transparent terms why Zillow Offers numbers are not a true representation of the business metrics.

In fact, one of the most famous short investor of all time, understands Zillow’s business metrics very well.

Watch “Eisman Is Short Zillow, Says It’s Entered a `Terrible Business'” on YouTube

https://youtu.be/tO73ksGQyqQ

Thanks Ben.

I’m not sure I understand why #1 is important. Why is it a positive for shareholders if profitability continues to decline, even as revenues go up?

As for #2, I’ll have to see if Brad Safalow can educate me. 🙂 Of course, it would be nice if Redfin would do like Zillow and release unit economics numbers for Redfin Now. As for Eisman, well, at least he has the courage of his convictions and put money where his mouth is. I think I understand his point of view too, btw, which seems to have to do with free cash flow and low capex and multiples that tech companies get vs. property companies.

But of course, I just disagree fundamentally with the “house flipping” take on iBuyers, whether Zillow or Opendoor or Redfin.

1. You are right – The decline of gross profit margins in Redfin’s primary brokerage business is a concern and needs to be addressed. As you know, the two main levers for improving margins are agent effiency and conversion rates. With declining conversion rates, even by counter-balancing with increased agent efficiency, gross margins still declined in the 2nd quarter. BUT they explained clearly that they spent $ in Q2 for tours etc that will pay off with either a minimal decrease or a flat yoy gross margin in Q3. This is an important point. If Redfin is successful at flattening then slowly reversing the graph you showed above – Redfin’s valuation and multiples should expand in shareholders favor.

2. I only hope that individual investors are doing their own math when it comes to the I-buying business model. I would hate to see human beings lose money because of confusion around the economics of the business. That seems unfair to me. Other sources demonstrate the numbers in a different light. For instance, https://wolfstreet.com/2019/05/10/house-flipper-zillow-lost-109k-35-per-flip-net-loss-triples-shares-soar/

Lastly, your most recent article on the NAR lawsuit is very interesting. The transparency of the costs associated with the tariff of buying and selling a home is going to be a game changer. My experience suggests consumers do not understand the economics of the transaction. Certainly not first time home buyers. They still believe that the seller pays the fee for the buyers agent. If Millennials are educated on the cost of a buyers agent – many will do it themselves!

Comments are closed.