After RE/MAX reported last quarter, I wrote a post saying that RE/MAX was poised on the brink of greatness, but was refusing to make the jump. Q2 earnings results do nothing to make me change my mind on that, but now, there are signs that RE/MAX is going to have to make some difficult choices sooner rather than later.

Before we dive in, I should let everyone know that I had the opportunity to visit RE/MAX a couple of months back and have some in-depth conversations with some of the senior executives, including Adam Contos. I won’t use or divulge any of the information learned during that visit, but I will relate that I came away extraordinarily impressed with Contos and the team that he has assembled around him. They’re far from sleepy dinosaurs stuck in the old ways of real estate from 1973. They’re smart, relatively young, energetic, and driven. They all understand the industry, understand the business, understand franchising, understand brokers and agents, and are (once again) poised for greatness.

Just as with Realogy, I have a great deal of confidence in the management team at RE/MAX.

At the same time, with the Q2 earnings results, one has to evaluate what has been done in the last three months instead of what might be done in the next three years. And I came away from these results and from this earnings call more convinced than ever that RE/MAX will be approaching a crossroads of sorts sometime soon-ish.

Let’s get into it.

The Numbers

We begin, as always, with the numbers:

A note about these numbers: I simply ignored the Marketing Funds line from both the revenues and the expenses, as they net out perfectly. And as Karri Callahan, CFO, pointed out during the Q1 earnings call, that netting out is due to contractual obligation to use all the money collected. So I felt that including them distorted the core business of RE/MAX by inflating revenues and expenses both. So I just took them out.

Once you do that, what you end up with is a meh story at best. Revenues were down 1.8% YOY, but management cut expenses by even more, so Operating Income, Adjusted EBITDA, and Net Income were all up, significantly in the case of Net Income (up 12.1% YOY). As Adam Contos put it, RE/MAX delivered “resilient results in a challenged market”.

Since RE/MAX’s business model is almost completely dependent on agent headcount, that number is a key metric (perhaps the key metric) for RE/MAX. And that wasn’t good. Q2 ended with 127,020 total agent count, but in the absolutely critical U.S. market, agent count actually dropped 2.8% YOY from 64,495 to 62,700. That’s almost 1,800 agents who left RE/MAX, whether to go somewhere else or to drop out of real estate, we don’t know. But it’s shrinkage.

Worse still, Q2 is now the third straight quarter with YOY declines. Q4/18 saw minus 0.1%, Q1/19 saw minus 1.5% and now Q2 is nearly double Q1’s YOY losses at minus 2.8%.

Canada, the second most important market for RE/MAX, is basically flat: 0.3% YOY growth, but over two year period (Q2/17 to Q2/19), we’re talking about a 1.8% increase, or 380 agents added to Canadian operations.

If it weren’t for international growth, RE/MAX would have no growth at all. In fact, from 2017 to 2019, RE/MAX lost agents in North America, its core market.

Now, the reasons for the decline, according to Contos and Callahan in the earnings call, is that the North American housing market is weak and that there is increased competition. Here’s Contos:

On the left, you can see our U.S. agent count down by 2.8% year-over-year which is a bit more than we anticipated at the beginning of the year. Our U.S. count most recently peaked in the summer of last year right before the market cooled abruptly last fall. Our U.S. agent count has historically moved directionally with existing home sales. The uneven existing home sales performance during the quarter on the heels of two weak quarters that we experienced near double-digit declines has contributed to the lag in our agent count.

Furthermore, as I mentioned earlier, the overall market has been softer than expected amid a highly competitive environment contributing to slower than normal recruiting and as a result our agent count mix has been less favorable than anticipated.

So if RE/MAX’s agent count — the key metric of its mostly flat-fee based business model — goes up and down with the housing market, and the housing market is soft (at one point, Karri Callahan called the last nine months a “kind of a mini recession” for housing), and competition from high (Compass) and low (eXp Realty) is intensifying… what’s the strategy for reversing the decline?

Booj to the Rescue

Adam Contos spent quite a few minutes on the summer rollout of booj, the technology platform that by all appearances RE/MAX is betting the future of the company on.

I’m not going to spend a ton of time and energy on booj because… I don’t think it matters. But do listen to the earnings call or read the transcript to find out all of the wonderful things that it does.

What I do think is worth spending time on is what Contos thinks booj will do for RE/MAX and its agents. He says that booj represents the “long game” for RE/MAX and then says:

The booj platform is an integrated suite of products that enables agents, teams, and brokers, to proactively establish, manage, and grow relationships. It’s about making our highly productive network even more productive and their businesses more successful by making easier connections with consumers, centralizing the interactions, and enhancing the experience. The first products to be released within the platform over the next few weeks will be the core set of agent tools. These centre around productivity management tools with comprehensive CRM, the core of the booj platform that deeply integrates with the product suite.

The platform addresses the main business challenges agents have identified including building one’s digital brand, lead management, and cultivation, transaction management and importantly client engagement and experience. [Emphasis added]

We’ll get to the “make productive agents even more productive” later, as it goes to heart of RE/MAX’s dilemma. But the basic idea, that booj is going to enable agents, teams and brokers to proactively establish, manage and grow relationships, just… doesn’t ring true for me.

In fact, it reminds me of advertising from golf equipment companies. Like this one:

You can outfit me with this amazing golf club, along with a full set of whatever the latest and greatest designs are in woods and irons and hybrids and putters and golf balls that are said to fly straight and far and more or less find itself into the hole. Give me all of the best damn equipment in the world, and I’ll maybe shoot a 74… on the front nine. Because I suck at golf.

Mobile CRM isn’t going to make an agent somehow better at having conversations with prospects. Automated social posting often means more people unfollowing you because they’re tired of seeing your listings on Facebook or Twitter. Website Editor is great… if the agent knew how to write. Sphere Scoring is wonderful, if the agent would only pickup the damn phone and make a call, but it isn’t going to call that old college buddy of his and have a conversation about real estate for him.

In other words, booj could be the greatest real estate practice software platform ever devised by the mind of man, and it still won’t make a crappy agent who can’t have conversations, who won’t make phone calls to her sphere, and doesn’t know how to do a deal into an expert anymore than a golf club is going to make me into Rory McIlroy. I was given a tour of booj, and met many of the people behind it, and yes, it looks like really great software… but it’s still just a tool. No tool in the history of human endeavors has ever created an expert out of a newbie.

As I have said about booj and RE/MAX when news of the acquisition first came out, if technology made bad agents into top producers, Realogy would have been dominating real estate since 2014 when it acquired ZipRealty and spent years and hundreds of millions of dollars rolling out the Zap Platform across its network. Given that we kind of know what’s happening to Realogy, it seems obvious that technology tools do not change a company’s fortunes.

What booj will do is to make good agents into great agents and great agents into superstar agents. I imagine it’s the same with golf clubs; it might make a good golfer into a better golfer, and maybe advanced technology would help a pro golfer make the cut. Because tools do not impart skills; skills make use of tools.

So that’s great, right? It is… kinda sorta… but keep reading.

Segmentation? Tell Me More…

We now come to the most eye-opening part of the earnings call. Tony Paolone, an analyst with JP Morgan, flat out asked Adam Contos whether the U.S. needed more agents given how everybody including RE/MAX was trying so hard to make agents more efficient and more productive. Contos’s answer is fascinating:

Adam Contos

That’s a great question, Tony, and thanks for asking that. Because I think what that does is it begs for us to take a hard look at the segmentation in the agent population and agent isn’t an agent isn’t an agent. And I think what we have is we have several different levels of agents operating in this space. We have, when you look at the industry statistics and the average production rate of the RE/MAX agents, our agents are the highest producing agents according to the national surveys.

I think we need more highest producing agents and I think we have — there’s a place in the market for agents that are what you can call developing that are under the supervision of really good brokers or high producing agents to help them come to the level that the consumer expects. And that’s really the biggest cry that the consumer desires I believe is to have an expert representing them and an expert leading them the way through that. I think we will see a reduction or maybe an increase churn at the bottom in the marketplace which with the ebb and flow of the marketplace we typically see that accelerate at different times.

So to say that there should be a blanket statement fewer agents I think you could say yes that’s probably correct. But I think where those agents come from in the segmentation in the marketplace is really what should be noted and I think that will be those that are willing to provide the greatest level of experience to the consumer through their professionalism and the tools and resources that they have available to them. [Emphasis added]

Oh my. Oh my oh my oh my. Do tell me more, Adam Contos, you handsome devil you. Tell me more about this segmentation of the agent population to see when an agent isn’t an agent isn’t an agent.

Fact is, all of us who have spent any real time in the real estate industry know that what Adam is talking about is literally the truth. Entire Facebook Groups devoted to Raising the Bar do not exist if there were not enormous gaps in professionalism, knowledge, expertise, sales ability, and even work ethic between agents. The paeans to the real estate agent, about how consumers want expert help and guidance, and how important agents are, and how the agent is the backbone of the industry and so on coming from everybody from Adam Contos to Robert Reffkin of Compass to Rich Barton of Zillow should all have a verbal footnote that says, “Only applies to good agents who know what they’re doing.”

It makes eminent sense for Adam Contos to admit this, especially since he spent so many words in both the prepared remarks and in the Q&A on how RE/MAX is home to the best agents in the industry. For example:

Turning to Slide 5. RE/MAX is known throughout the industry for being home to top producers and third-parties continue to confirm that view. RE/MAX the world’s most productive Real Estate Network had more agents recognized than any other real estate brand for the annual ranking of America’s best real estate professionals by REAL Trends and Tom Ferry. This is the fifth consecutive year RE/MAX has been home to more of America’s best agents, with 20% of all participating agents and teams being members of the RE/MAX network. The strength of the RE/MAX network has always been rooted in our brokers and agents, the stars of the real estate industry. RE/MAX has more agents in America’s best ranking of real estate professionals than any other real estate brand. Our agents are consistent and unmatched in their productivity, talent, and dedication to their businesses and clients.

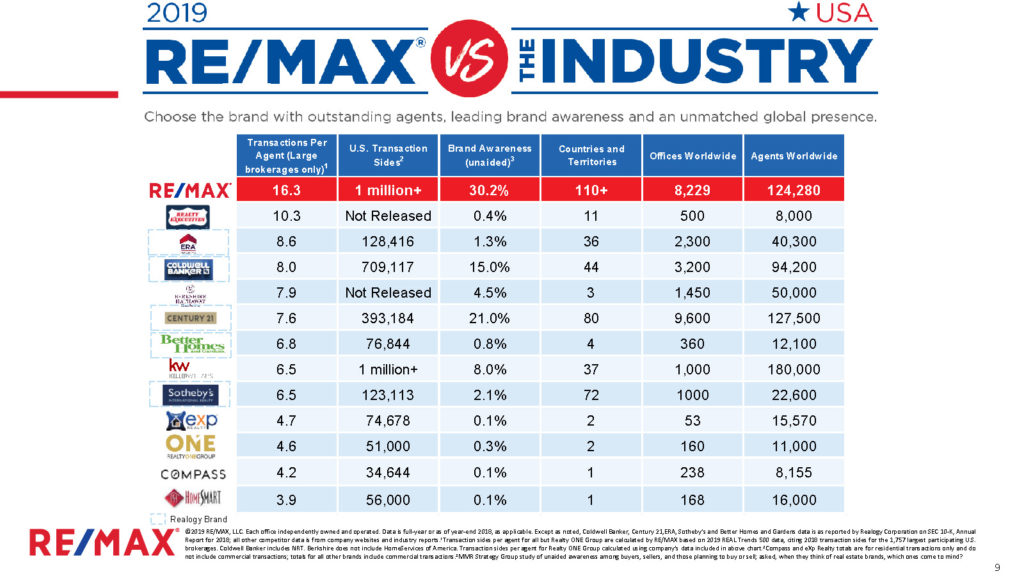

And here’s a slide from RE/MAX’s Investor Presentation dated August of 2019:

RE/MAX does have some of the best agents in the business under its flag balloon. RE/MAX has more of them than other major companies. The stats show it.

Except that Adam sort of told the real truth that some of their agents are consistent and unmatched in their productivity, talent, and dedication… while others… aren’t. Segmentation. An agent isn’t an agent isn’t an agent.

This is where things get sticky for RE/MAX.

Something’s Gotta Give, Yo

The rollout of booj means that RE/MAX’s core strategy is to make their great agents better, and their good agents great. That makes sense since RE/MAX agents have the highest productivity among “Large brokerages”… at least large brokerages not named Redfin. (Redfin is either the #4 or #5 largest brokerage by Transactions and by Volume, so it’s odd-yet-understandable that Redfin is left off the table above.) booj might be a godsend for those RE/MAX agents who are good to great, and all of the benefits that Adam Contos talked about in the call may very well attract even more good to great agents to RE/MAX.

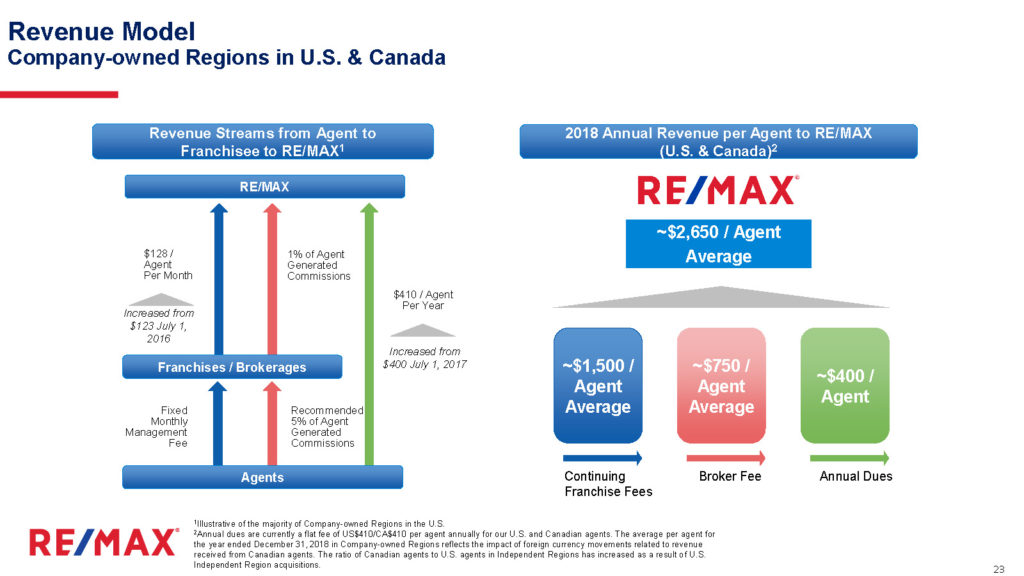

The problem is that RE/MAX’s business model is, in the words of RE/MAX itself from the Investor Presentation, “Multiple, primarily recurring, fee-based revenue streams.” In other words, RE/MAX’s revenues depend primarily on flat fees from agents to brokerages who then pay RE/MAX.

The Investor Presentation spells it out in detail:

So unlike Compass or Realogy or Redfin or even eXp, most of RE/MAX’s “recurring fee-based revenue stream” depends entirely on the quantity of agents, not the quality of agents. Only the Broker Fees rely on agent quality, since that’s based on GCI, but the “split” for most RE/MAX brokerages are recommended to be 95/5, compared to Compass’s reported 85/15 and Realogy’s 72/28 split as I computed in Q1. True, Broker Fees is still the second largest revenue line item for RE/MAX, but this is precisely where something’s gotta give.

The competitive pressure that Contos mentions is coming from above (Compass) and below (eXp and 100% Brokerages). From above, the super agents that RE/MAX prizes are being heavily recruited by everybody, including Compass. Because of Compass’s aggressive recruiting tactics, every brokerage in North America has to bend over backwards to keep their superstars, including offering them extremely high splits, financial incentives, and a float in the Macy’s parade. (Well, maybe not a float in the Macy’s parade… but depends on the office and the managing broker….)

The loyalty to RE/MAX, and the possibility that booj will help those superstar agents become even more productive and more efficient could help there. But that “segmentation” truth above suggests that RE/MAX has to contemplate a world in which the greater efficiency and improved productivity that software tools provide to great agents means even more deals, more market share, and more commissions to those great agents… at the cost of not-so-great agents.

On the other end of the spectrum, RE/MAX franchisees face massive cost-based competition from eXp and a plethora of new 100% NextGen Brokerages some of whom offer caps on flat fees, and in at least one case I know of, a flat $150/mo all-in no-other-fees price. Many of those segmented out from the top tier ranks would find those companies to be a more attractive place to hang their license to do very little business versus a RE/MAX franchisee who has to collect desk fees and other fees to pay the mothership as well as a 95/5 split.

That’s quite a pickle, strategically speaking.

It ends up being the same strategic pickle that every other brokerage not named Redfin faces: how do you generate more profit from your best producers, who are independent contractors who pay you, instead of the other way around?

If RE/MAX continues to bolster the productivity of its good to great agents, they can go demand even better terms from their brokerages… or jump ship to someone who will offer them the sun, the moon and the stars. But even without demanding better terms, a desk fee is a desk fee, whether a super agent does 50 deals or 500. And as those great agents take more and more deals away from the less-great agents, those less-great agents find themselves less and less able to pay the desk fee and other fees… which gets them looking at lower-cost alternatives… which leads to decline in agent count… which leads to lower revenues for RE/MAX.

But if RE/MAX doesn’t focus on the best agents, then it isn’t delivering on what consumers demand: to have an expert representing them and an expert leading them through the transaction, to use Contos’s own words. And eventually, those high per-agent productivity numbers dip since no tool, including booj, is going to make a crappy agent into a good one.

Something has to give, eventually. Segmentation is a five-dollar word that simply means that RE/MAX is going to differentiate between good agents and bad ones. But once you’ve done that, now what? What can RE/MAX do about the bad agents when their entire business model relies on having them pay fees?

Long Term Problem

To be fair, this is a long term problem for RE/MAX, not an immediate next-quarter or next-year problem… probably. RE/MAX today is still very profitable, still throwing off $30 million in free cash flow, still paying dividends, and still has pretty low debt burdens (1.5 x Adjusted EBITDA). RE/MAX still has some $72.5 million in cash, which once meant something, until Compass came along.

RE/MAX has the time and the capital and the management team to come up with something before the conflict between its long game of booj and more productive good agents and its headcount-based business model collide. But it does have to come up with something. Providing tools, no matter how great, is not the answer, not by a long shot.

As a final note about long term problems and possible long term solutions… RE/MAX’s market cap as of this writing is about $500 million. In March, Opendoor raised $300 million on a $3.7 billion valuation. Opendoor is paying referrals to agents to bring them deals, and it just entered into a partnership with Redfin, who only has some 1,600 agents in North America. RE/MAX has over 84,000 even with the declines. And of course, Compass just raised another $370 million on an astonishing $6.4 billion valuation, and we already know Compass likes top producing agents. #JustSayin #WhoKnows #GameChanger

We shall see what Contos and his very capable team will do in the months ahead, as I have enormous faith in the people I’ve met back in May. But no matter how great they are, no matter how poised RE/MAX is for greatness, I can say with a clear conscience that someday, something’s gotta give.

-rsh

1 thought on “[VIP] RE/MAX, Q2/2019: Something’s Gotta Give”

Hi Rob – RMAX market cap is > $800 million. The $500 million from Yahoo Finance is based on ~17-18m shares (while the true FD share count should be >30m).

Comments are closed.