If you haven’t done so already, or were not present when the panel happened, go watch the Inman News video on the big commissions lawsuit(s) panel discussion. Inman Select membership is required.

I thought it was great, especially since Jack Bierig, one of NAR’s outside attorneys on this case, was present to provide some insight into how NAR was thinking about the lawsuit. I also thought Russ Cofano did a great job of pointing out some uncomfortable truths. And Rebecca Schuetz from the Houston Chronicle did a great job of presenting the issues from an outsider’s/consumer’s point of view.

Since I’ve written about this lawsuit and the DOJ investigation fairly extensively, I just wanted to point something out that wasn’t really discussed on the panel. It really couldn’t be, as it came kind of towards the end.

Russ Cofano, who is an attorney as well as a broker with Windermere in Seattle, said:

This is going to go into discovery. And a lot of practices that are going on in the business are going to be open for the plaintiffs to poke at.

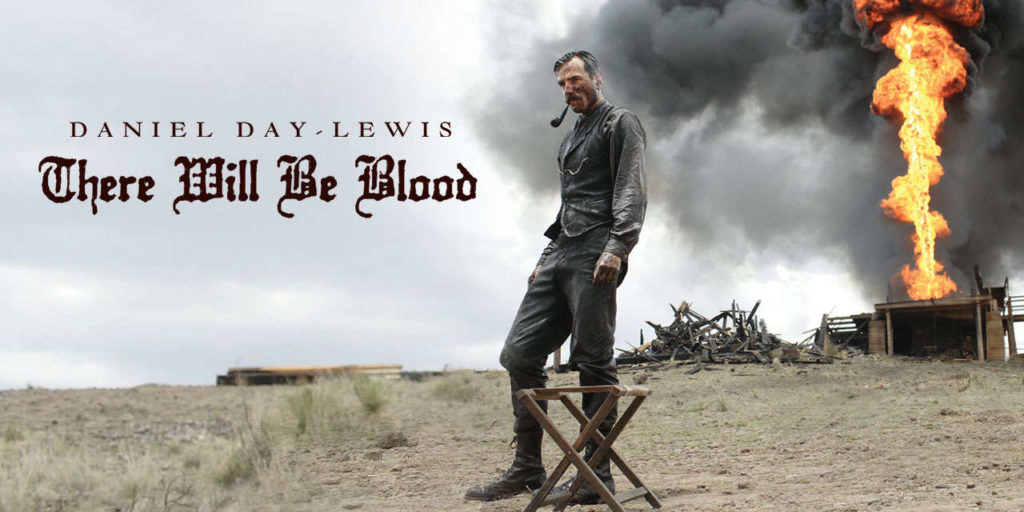

The thing to realize here is that if Moehrl v. NAR (and any copycat lawsuits) goes into discovery, as it appears that it will, that alone will change things. Even if the defendants ultimately prevail in the lawsuit, there will be blood.

Commissioner of Competition v. TREB

I wrote a longass Red Dot report on this case from north of the border in November of 2018, so I won’t go too much into detail here. But in the course of researching that case, I ran across some of the discovery that was done by the Competition Bureau (Canada’s equivalent to our Dept of Justice Antitrust Division).

For those interested, the source of these things is from the Competition Tribunal’s Order and reasons for the order. It’s 175 pages of legalese; caveat lector.

In the 175 pages, I ran across this:

Three days later, [CONFIDENTIAL] a member of TREB’s Board of Directors, sent an e-mail to [CONFIDENTIAL] colleagues on the Board stating: “This is worse than a knee replacememt [sic] … I say let them start their own VOW.. [sic] let them get their own information and show us how great it is.. [sic] never mind all the privacy issues […] and what type of mess would we all be in if they have their way …” (Exhibit CA-056, [CONFIDENTIAL] RE: Competition Bureau and TREB- Notice of Application, at p. 1; Transcript, September 27, 2012, at pp. 1689-1694).

Now, that’s a pretty tame email from one Board member to others on the Board about a fairly narrow issue. But the lawyers for the Competition Bureau found that email in discovery. Who knows what else they found and how that might have affected the thinking of the Competition Bureau.

There are literally thousands of pages of witness depositions, documentary evidence, etc. and obviously, I didn’t read them all.

What I can say with a fair amount of confidence is that competent lawyers doing discovery will find stuff.

Think About Your Own Boards and Your Own Brokers

Many of you are on Boards of Directors of MLSs and Associations, including many on the NAR Board of Directors (which is larger than Congress). Many of you are CEOs of MLSs and Associations, and many others are CEOs of brokerage companies. Think about your Board of Directors.

Now think about all of their emails for the past five years or so being turned over to the lawyers for Moehrl. Think about all of your meeting minutes being turned over to the lawyers for Moehrl, assuming you kept good meeting minutes.

I’ve been in numerous board meetings of various MLSs and Associations over the years. Some of the things discussed and ideas brought up and issues debated are not things I’d want to see the light of day for the sake of the individuals who discussed them, brought them up, and debated them. Frankly, I’ve heard some comments from Directors that are out and out illegal, and at the very least anticompetitive. I’ve heard concerns that have to do with fast-growing low-cost competitors, that have to do threat of technology, etc. etc.

How many of your Directors emails and text messages and words from meeting minutes do you want falling into the hands of hundreds of young eager beaver lawyers who put in 80 hour workweeks? For that matter, how many of your emails over the past five years or so to your staff and your Board would you want the lawyers from Hagens Berman and Cohen Millstein and a dozen other law firms reading?

Since the Moehrl lawyers are suing four corporate defendants as well, and since buyer steering is the key theory of the plaintiffs, think about your own Managing Brokers and their communication, their training, their advice to their agents. How many of those emails over the past five years would you like to turn over to the Moehrl lawyers? Think any of them might have said something like what Keller Williams training/coaching is supposed to have taught?

As Russ Cofano said on the Inman panel, “We know that happens.” We just don’t know how prevalent that is.

The discovery will attempt to establish just how prevalent that is, and if the Moehrl lawyers have to dig through hundreds of thousands of emails… with billions of dollars at stake, I rather think they will dig through hundreds of thousands of emails.

And while they’re digging through those emails, meeting minutes, training scripts, and so on… what else could they find? How many of your managing brokers do you want being deposed by some of the best litigators on the planet?

Discovery Is Hell

Attorneys like Jack Bierig deal with discovery every single day. It’s their job. It’s their profession. And the good litigators are amazingly good at discovery; that’s what makes them good litigators.

I’ve been through discovery a few times, both personally and professionally. I can tell you without reservation that if William Tecumseh Sherman is wrong and war is not hell, then discovery is.

Lawyers will often tell you, “Dance like no one is watching; email like it may be read aloud in open court one day.” That is solid legal advice, but let’s be honest… very, very few of us are going to follow that advice. We all write dozens if not hundreds of emails a day. We send text messages dozens if not hundreds of times a day. We all have frank and open conversations, especially in settings like Board meetings that are supposed to be confidential.

If the Moehrl v. NAR lawsuit survives dismissal, and I would be shocked if it did not, because even Mr. Bierig admitted during the panel discussion that getting a motion to dismiss succeed in antitrust lawsuits is difficult, then the lawsuit enters the discovery phase. Lawyers for Moehrl will start sending supoenas and document demands to NAR, the four named defendants, and I’d imagine every single one of the twenty “Covered MLSs”.

Imagine the phone call that the CEO of one of these MLSs has to make:

“Hey, so I know you served on the MLS board four years ago. I need you to collect all of your emails to the Board, to any other Director, to me, to anyone on staff from four years ago and send them to our law firm. Oh, and any meeting notes and text messages from four years ago.”

I can’t find my emails from last week; you want me to dig up old emails from four years ago? Who’s got time for that?

I agree with Russ Cofano who said MLS Boards need to go have a discussion on whether they want to make any changes, like NWMLS has done. While they’re having those discussions, might I also recommend that they have discussions about how they will comply with the inevitable discovery demands, interrogatories, subpoenas and so on? Because the process is the punishment here, and discovery is hell. If the MLS is not willing to make any changes today, I’m willing to bet that many of them will become willing after doing through few months of discovery.

There will be blood.

-rsh

8 thoughts on “There Will Be Blood: NAR Lawsuit and Discovery”

It is very clear to me at least, that the MLS dose not want to change a thing and wish that the internet was not exist.The problem is that real estate agents are not aware that these MLSs with their 1800s century business model, will put most of them out of business.Many agents I personally know DO NOT want any changes.They are not a consumer centric. All they really want to do is to continue open the lock boxes, to lie on how many offers the property got, not showing all offers to double end the transaction, and make their 6% commission.

Hi Bert – Unlike Rob, I am not an attorney but did graduate from law school 50 years ago.

I know many, many laws changed and new laws added. I have wondered about this 6% thing for a few years and have often asked myself, why has no one jumped on this?

WELL, they have, and I have confidence that the plaintiffs will prevail. I know not what the end result will be, but I think the industry will be held up by the heels and have the s*** shaken out of them. What parts of the lawsuit I’ve read seems they have a cause of action that hits the nail on the head.

I do not see any way on earth that the 6% can be disproven as price fixing. It is nationwide and pervasive throughout the industry.

This may change the industry more so than banks getting brokerages, and we know how frightened NAR is about that. Happy days are NOT here again.

No blood.

A dismissal may indeed preclude all your ramblings

The USA/NAR seems to be 10-15 yrsa behind CREA/ TREB vs Big Brother Canada Competition Bureau.

Study our situation for a time

I wrote an entire 70-page paper on Competition Bureau v. TREB. You guys are the canaries in the coal mine, as I’ve been telling U.S. Associations for quite some time now.

Hello Marvin Shelley,

Going to court is like flipping a coin. You can not never know what the court will decide. However, 90% from cases are settled before going in front of the Jude. I see NAR trying to settle this lawsuit asking buyers to pay the commission to their agents. It is only make sense that a seller will pay his agent who represents him and the buyer will pay his agent who represents him. Why a seller should pay commission to an agent who does not represent him? Can someone answer this question.

Hi Rob,

Good piece…

Couple of things. For those who don’t have an Inman Select subscription, they can listen to a bit of my comments here. I thought the discussion was good but not nearly long enough to dive into some important things. https://www.linkedin.com/posts/activity-6564195270995910656-DgN5

Also, there is a legal term relevant to discovery called “spoliation of evidence”. MLS and associations would be well-served to have their counsel educate leaders and employees about what this term means and how they may intentionally or inadvertently bump up against it. In other words, hitting the “delete” button may be a very bad idea.

Thank you Russ!

And OMG, such a good point about spoliation… yes, for certain MLS and Association boards need to get educated on that ASAP.

I guess I could say a lot of things here, but this one observation may be of the most importance.

While attending an industry conference in New York City this past year, I was shocked when a broker on a panel declared that, “he had no idea of – nor did he have any control over – what his agents were saying to consumers in their living rooms.”

Really?

If you position that proclamation with the claims of this lawsuit, and then add in the process of discovery, that puts things into a whole new perspective for the outcome of this action.

Consumer lawsuits that are being back-stopped by DOJ investigations have little regard for the constant challenges our industry faces in assuring the proper controls placed on independent contractors. The actions are the actions, the evidence is the evidence and unfortunately, the damages are the damages.

Change is inevitable. It’s just too bad that in this case, we as an industry, didn’t realize it coming before it became a reality.

Comments are closed.