Maybe it’s the frothy spring real estate market where multiple offers and higher prices are blooming like tulips, but there is yet another please-dear-god-let-this-be-true prayer disguised as a news story making its way around the Interwebz.

The persistent prayer is that the Millennials will unleash themselves into the housing market and buy up homes left, right, and center. We’ve heard this before. In fact, we’ve been hearing it for ten years now. But the latest comes from Pulte Homes, who have no vested interest whatsoever on the issue. (H/T: KCM Blog)

Because there’s a few yummy pieces of truthiness in this “news story”, I felt like dissecting it a bit.

The Pulte Survey of Millennials

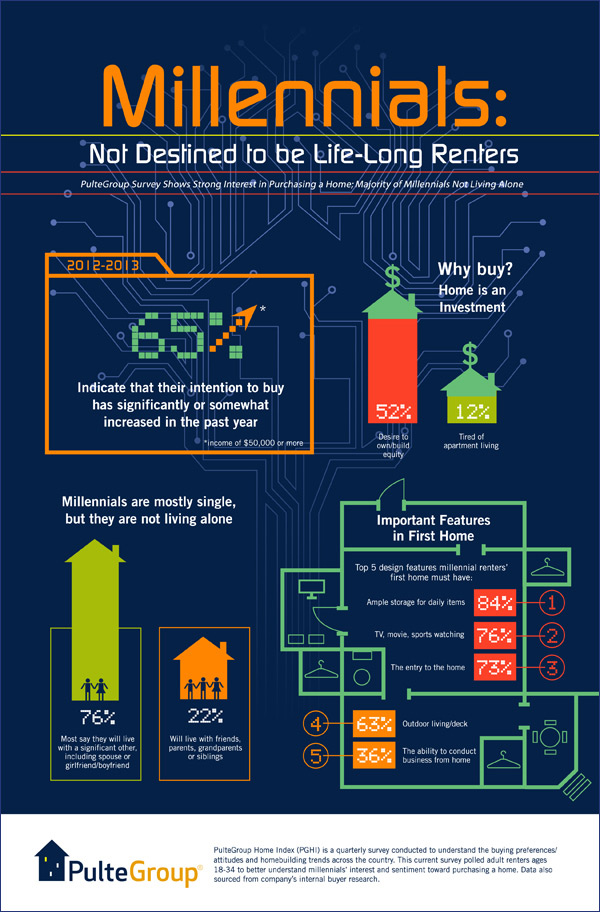

We may as well begin with the 65% increase in Millennials who say their intention to buy has increased last year.

In similar news, a survey of my neighbors indicate a 90% increase in the number of people who say their intention to make more money has increased last year. Also, 100% of people with chronic illnesses say their intention is to get better.

There has never been any question about the desire of Milennials — or any generation of Americans — to own a home. If money were no object, everybody under the sun would want to own multiple homes in fantastic neighborhoods and hip cities and fly around in private jets, Al Gore style.

The issue isn’t desire, but ability and circumstance. So we go to the accompanying press release:

BLOOMFIELD HILLS, Mich., April 1, 2013 /PRNewswire/ — Millennials continue to show a strong interest in purchasing a home, according to the PulteGroup Home Index Survey (PGHI) by national homebuilder PulteGroup, Inc. (NYSE: PHM). For renters ages 18-34 with an income of more than $50,000, 65 percent indicated their intention to buy has significantly or somewhat increased in the past year.

First of all, while I realize that Millennials include some 34 year old people (many of them in Sociology Ph.D. programs), I think it’s more useful to look at the Class of 2008 and younger. Because 2008 is the year that college students were graduating from a Gun Free Zone of college campuses onto a Job Free Zone. That means 27 and younger. The older Millennials are really cusp Gen-Xers.

Second, income of $50,000 automatically eliminates at least 22.9% of the 18-24 population, since they’re unemployed. Half of college graduates are in jobs that don’t require a college degree, like being the cool hipster barista at Starbucks, with its average salary of $33,726. So let’s understand that “renters with income of $50,000” means the upper echelon of the Millennials.

Third, since they’re in the upper echelon, they’re likely to be college graduates. Which means that on average, they’re carrying $27,000 in student loans. After paying their 25% income tax, our renting Millennial is left with $37,500. The student loan payments will be around $300 per month, and let’s assume that car, gas, food, entertainment (gotta date somehow, right?), and so on will amount to a piddly $700. Our Millennial will be able to afford a $47,388 house… and that’s with a $20,000 down payment, which would take our Millennial an interestingly long period of time to save up. Unless they all plan to move to the soon-to-be up-and-coming areas of Detroit or Camden, NJ, that $47,388 house is going to be all sorts of interesting.

Ah, but DINK (Dual Income No Kids) will be how it works out.

Additionally, the vast majority of millennials aren’t moving into their first home on their own. Millennials plan to be coupled in their home with 76 percent indicating they will live with a spouse or significant other, and of those not moving in with a significant other, 22 percent anticipate having a roommate, including a friend, parent, in-law, grandparent or sibling living with them.

Sadly, with female-male ratios on our campuses running 60/40 these days, and phenomenon like SWUGNation busting out even on our elite campuses with 50/50 ratios, all family formation numbers of Millennials should be viewed with suspicion.

According to the infographic, 76% plan to be living with a spouse. Well, since the laws of mathematics dictate that 1 out of 3 female college grads can’t meet a male college grad, unless we see a new social trend of college-educated women marrying a bunch of blue-collar dudes with GED’s, or polygamy is legalized, or there will be far more gay marriages than anyone ever suspected, the plans of quite a few of the 76% are going to remain plans for quite a while.

Finally, although few people talk about this all that openly, primarily because it’s so terrifying to even think about… Boomers are retiring. And they really haven’t saved that much for retirement, due in part to the whole housing crash, zero-interest rate policy, and global recessions. Guess who will be footing the bill?

Hooray for Gen-Yay!

But hey, who needs such a bummer so early in the day. Why let things like numbers get in the way of crunchy good truthiness about the intention of Millennials and what they want in a first home? Let’s keep partying like it’s 1999!

-rsh

Comments are closed.