Once again, it is time for the world famous (in my own mind at least) annual tradition of making predictions for the coming year that are Guaranteed to be Wrong, or Your Money Back! This year, I thought I would pay tribute to the greatest musical act still working today: Alison Krauss and Union Station. If you haven’t experienced AKUS, please click on the embedded videos; you will become a fan. If you are not a fan, you should be. “But I hate country music” is no excuse when it comes to the awesomeness that is the Hall of Fame lineup of Alison Krauss, Jerry Douglas, Dan Tyminski, Ron Block, and Dan Bales.

My 2012 Predictions turned out to be mostly wrong, which is great news, since many of them were dire indeed. Here’s to hoping that my 2013 predictions will perform about the same.

Let’s get into it.

1. The Housing Market Defies Expectations

If I didn’t know any better, I’d be inclined to agree with the sunny optimism of Diana Olick at CNBC:

The housing market is on firmer ground today, as two major tax provisions survived the “fiscal cliff.” Congress did not touch the mortgage interest deduction, and it extended tax relief for one year on mortgage debt forgiveness.

“An extension of the tax break is positive for home values by reducing the number of foreclosures and helping more troubled borrowers stay in their homes,” wrote Jaret Seiberg of Guggenheim Partners. “That means less supply on the market.”

I predicted last year that the housing market would continue to decline; I was wrong about that, thankfully. But I look and I look and well, I’m not a sophisticated economist or anything, but I’m just not seeing the improvement in the underlying fundamentals. It could simply be that I’m too much into doomporn like Zerohedge, or that I really would like my stash of gold and silver bullion to be worth more, but… none of the fundamental math equations have changed.

Last year, I figured we wouldn’t see any major policy action out of Washington DC because of the Election. I thought the results would be different than they were, but turns out that American voters felt differently. So we have exactly the same dynamic in Washington DC today as we did for the last four years: Obama in the White House, Democrats controlling the Senate (but not a filibuster proof majority), and the Republicans controlling the House.

The fiscal cliff deal is criticized roundly from all corners of the politicosphere, and no one anywhere thinks that settles the economic policy questions. Everyone assumes that we’ll have another major showdown over the debt limit and the continuing resolutions (which is necessary since Congress hasn’t passed a budget since 2010) and that will be the real showdown.

So as I write this on January 4th of 2013, thinking that items like the mortgage interest deduction are safe is, I think, a bit premature.

But to the maths.

Prior to the fiscal cliff deal, the Congressional Budget Office was projecting deficits of $2.3 trillion from 2013 to 2022. After the deal, the CBO is projecting deficits of $6.9 trillion from 2013 to 2022. Perhaps 2013 will be yet another year of magical thinking and nothing bad will happen as we continue to borrow hundreds upon hundreds of billions. I’m not overly optimistic. There aren’t too many people who are.

Plus, the fiscal cliff deal did nothing much more than kick the can down the road some. So I expect that we’ll see serious and significant policy changes coming out of Washington DC before too long, and I expect that expensive tax expenditures (this is, money the Federal Government doesn’t take from you = expenditure in Governmentese) like the mortgage interest deduction is not too long for this world.

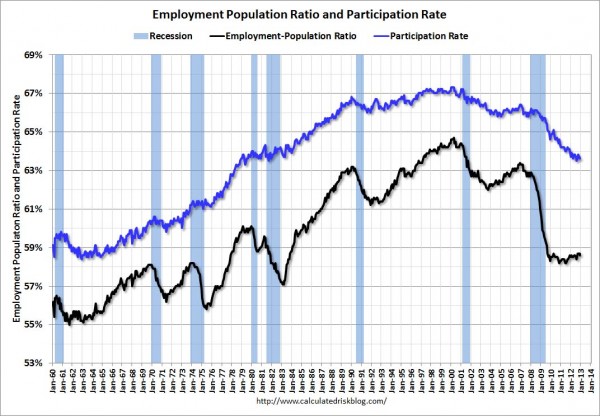

The December Jobs Report was meh at best since the unemployment rate held steady at 7.8% from November, but somehow, labor force participation numbers are down:

Lest we forget, even the AP is reporting that the fiscal cliff deal didn’t only hammer the evil one percenters making $400K, but um, everybody:

The Tax Policy Center, a nonpartisan Washington research group, estimates that 77 percent of American households will face higher federal taxes in 2013 under the agreement negotiated between President Barack Obama and Senate Republicans. High-income families will feel the biggest tax increases, but many middle- and low-income families will pay higher taxes, too.

And how housing can have a recovery while jobs are stuck in nowheresville is a magical question indeed. At least one housing skeptic thinks the reason is simple: manipulation by the Fed.

The Case Shiller data is showing a steady increase in home prices across the United States. The headline figures are clear but rarely make the connection that much of this gain is coming on the back of unprecedented Federal Reserve intervention. Data is clear that household income is not making any significant gains. These gains are coming largely from added leverage produced by lower mortgage rates. (Emphasis mine)

Dr. Housing Bubble blog thinks we’re in another housing bubble, driven by investor demand. Well, I hope he’s wrong, but fear he’s right.

Oh yes, before we leave this gloomy-ass topic, we do need to mention this:

Plus, the capital gains and dividend tax rates for these high-income households will increase to 20% from 15%. For everyone else, investment tax rates will remain at 15% or below.

Tax professionals will be busy, busy, busy with the rich people making $450K a year (who also have to deal with the 3.8% Obamacare tax on investment income). What occurs to me is… who are the folks investing in real estate, if not these, you know, rich people? And if taxes change their return on investment calculations, does that maybe change their view on how much to pay and for what properties over what period of time?

We’ll find out. But I’m predicting that the housing market will defy expectations and be “unexpectedly” bad in 2013, with a real possibility of a crash if investors pull out.

2. Industry Realizes that Renter Nation is Here to Stay

Closely connected to #1 is that 2013 will be when the rest of the real estate industry realizes that Renter Nation is here, and here to stay. I see that the first time I used the tag “Renter Nation” on Notorious was in July of 2011. We have had a year and a half of the real estate industry blithely ignoring renters, or if not ignoring them, not knowing what to do about them, while focusing with laser intensity (ok, maybe more like halogen lamp intensity) on social media, Pinterest, Instagram, and whatever else to generate buyer leads.

In 2012, I had the good fortune to speak to a group of top brokers in southern California, and I realized that there were a few of them who had seen the trend develop and had taken strategic steps to adjust to the coming market. For example, two brokers I had met had already built up a substantial property management business, and it was starting to get traction in the second half of 2012. Those brokers will be found smiling at industry conferences throughout 2013. The ones who haven’t prepared at all?

They’ll be the ones crowding the Zillow Rentals booth at conferences to hear all about how they can get into the action.

3. Finally, An End to Syndication War

I wrote last year that the syndication war is over, but that most people haven’t realized it yet. Well, 2013 will be when most people will realize it. You can let go now. It’s done. Lay down your arms, for the fighting is finished.

Sure, there may be a couple more big fights left before peace (or at least an armistice) is finally declared, but by the end of 2013, it will be plain to everyone but the diehard holdouts that the war is over. I have heard rumors that a major brokerage will challenge the big portals with a significant effort. We shall see how finally getting around to doing battle on the Internet will change things when mobile is the future of real estate (as I’ve predicted for 2012), but it reminds me of the lovely Tennyson poem.

But there are other signs that the war is all but over. For example, I’ve noted that there’s a group devoted to the idea of ending syndication. Since I wrote about NAREP on the most popular real estate media website in the world (that would be Inman, not this blog, heh) in October of 2012… it has garnered all of 35 Likes on Facebook. That’s not what one might call “energy”.

Furthermore, my contacts who remain anonymous to protect the guilty and the innocent tell me that major brokerages, franchises, and MLS’s have all changed their tunes towards the second half of 2012 in terms of working with the big portals, instead of working against them.

And I was recently asked to speak to the board of a major real estate technology company about trends and issues confronting the industry. The one topic they did not want to spend any time talking about? Syndication. Because “it’s a complete waste of time” according to the person who asked me to speak.

Add on to that my prediction #2, that Renter Nation will finally break through to industry’s consciousness, and the fact that the MLS is hardly a definitive source for properties for rent, combined with the fact that the top ten real estate websites (in Nov 2012) included rent.com and apartmentguide.com, as well as Zillow, Trulia, Realtor.com, Yahoo, AOL, MSN and Homes.com, all of which feature rentals prominently… and I’m predicting that 2013 will be remembered as the year when the syndication war ended.

4. Buyer Agency At Risk

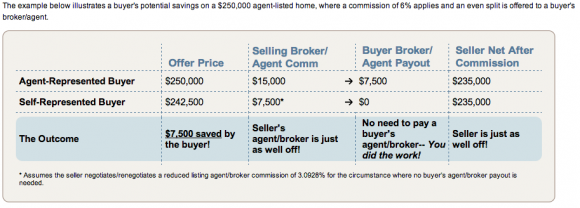

Every silver lining always seems to have a cloud that comes our way. In this case, it’s the silver lining of technology that brings the cloud: a real risk to buyer agency. The last time I mentioned this phenomenon, I got pilloried by the Legion of Licensees, who believe that until a state bureaucracy gives you a piece of paper, you cannot possibly interpret when buyers say things like, “I see no value in real estate agents.”

Well, if that Inman column bugged you, my latest one (not yet published at time of writing this it has been published now) should have you in a blood rage.

See, I discuss a little startup out of Minnesota called BuyerCurious. Its mission?

The pretty lady says, “Yes, BuyerCurious is for agents too.” Sure it is. For listing agents maybe. But its core value proposition is this:

And the tagline right there on the home page: “Be your own agent.”

As I go into depth on the Inman column — and will likely take up again on this blog throughout 2013 — the issue isn’t this one company. The issue is the loss of value of those services provided by buyer agents thanks to technology making things like property search and the transaction process far more efficient. Instead of taking that into account, the industry has tried to just defend the old model to the hilt, without looking at the experiences of other industries disrupted by technology.

The response to this is likely to go through the stages of mourning.

First, there will be denial. We’ve seen that already, and I suspect we’ll see it to this prediction.

Then we’ll get anger, either taken out on me your messenger, or on BuyerCurious — or any other startup like it.

Next comes depression, and we’ll see quite a few opinions suggesting that they can’t do a thing about the juggernaut that is technology and that the end is nigh.

And finally, probably not this year, but maybe next year, we’ll get acceptance. Savvy brokers and agents will figure out not just how to survive but to thrive in the new environment.

5. Associations Under Assault

2013 promises to be a year of major change for organized real estate, as the ghost in the house of REALTORS rises out of the walls. That ghost is named Governance, and it will haunt Associations for most of 2013.

The lawsuit against Greater Las Vegas Association of REALTORS (GLVAR) goes on. The motion to dismiss was denied, and the parties have gone into discovery. I noted in June of last year that this lawsuit has profound implications for organized real estate, and nothing has happened to change my view on that. If the GLVAR lawsuit results in either a significant judgment or a big settlement, then the plaintiff’s bar will go into assault mode.

But GLVAR wasn’t the only instance of the ghost Governance piping up. The Chicago Association of REALTORS also joined the party by bringing a defamation suit against one of its members, Andrea Geller, who happens to be not just any old member, but a former member of the Finance Committee.

Since I posted those two items, I’ve had private emails and messages from REALTORS who serve on their Association Boards who tell me one of two things. Either their Association has nothing to worry about because they keep obsessive records of all decisions, or that they’re screwed because they too have strange, opaque decisionmaking, and possible abuses of funds. The latter outnumber the former by quite a bit.

On a more positive, upbeat note, the Association faces change in 2013 through the reform efforts of NAR itself. REThink Future was a flawed process, but it was a real attempt by NAR to address the core question of the role of organized real estate in a changing world. That effort shows no sign of going away in 2013. Indeed, I suspect that it will pick up steam throughout 2013, especially as I’m skeptical on NAR winning any major legislative or regulatory battles in America the Brokest Nation in History.

Either way, whether forced through legal assault or through internal reform, 2013 is when Associations must either change or prepare to die. The current situation of wide disengagement by the membership, of deep distrust of staff and the board by the rank and file, of companies and agents joining the Associations solely for MLS access, is unsustainable. And that which cannot last, won’t.

I don’t believe 2013 is when Associations change wholesale; it is, however, when we’ll see the start of the changes.

6. Consumers Take Center Stage

It’s amazing how consumers can speak right to the agent’s heart without saying a word. But it’s even more amazing when they do say a word, or two, or two thousand.

I’ve been involved with HearItDirect throughout 2012 and some of the insights I’ve gained as a non-REALTOR have been significant. For example, I didn’t realize the depth of disenchantment with buyer agency until I heard consumers — especially the younger Gen-Y consumers — say exactly that.

But it isn’t as if HID is the only group doing consumer conferences in 2012. I know that many Association and MLS meetings included consumer panels. I know that even Inman put consumers on stage and asked them what they liked, didn’t like, and wanted. And while the voices of the soon-to-be-extinct agents who insist that consumers don’t know what they’re talking about, that problems are to blamed on them, etc. are still heard, I’m not aware of any business surviving for long insisting that it knows better than its customers as to what they really need and want.

Leaders in the industry have already begun the shift away from focusing on technology and tools to focusing on consumers. The Houston Association of REALTORS, for example, long touted as the leader in MLS technology practices, has shifted decidedly towards consumers. It has put together more than 5,000 consumers for surveys and online panels, and used them for things like setting HAR’s legislative priorities. Imagine that! A group that purports to defend homeownership asking homeowners what legislation they would like to see.

It is clear to me that 2012 marked an inflection point when social media and technology topics were no longer interesting or exciting to the majority of the industry. Oh, technology will still be important, to be sure, but I don’t think the obsessive focus on technology will be the norm in 2013 and beyond.

No, I think consumers and obsessive focus on consumers take center stage in 2013. Well, at least I hope so for the future of this industry.

7. Zillow Pulls Away

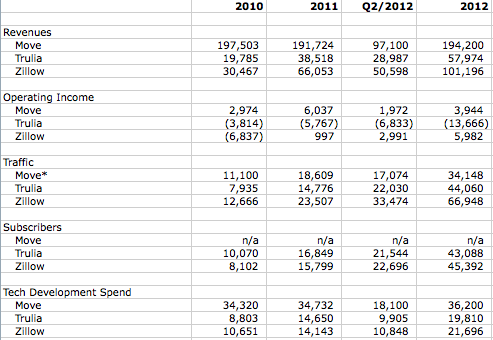

Although its competitors will certainly have something to say about the matter, on current trends, I believe that 2013 will be the year that Zillow really pulls away from the rest of the pack. Let’s look at 2012 for starters (note that we don’t have Q4 or full year results yet). I did that in 2012, looking at a few key metrics.

This isn’t the post to look at some of that in detail, although I suspect we’ll have fun with it once the full 2012 results are available from the Big Three.

But the one key metric I look at is unique users. I know this is a squirrelly metric since web analytics software is hardly 100% reliable, but… as of Q3, 2012, Realtor.com was talking about “more than 20 million” unique users, Trulia was citing “almost 25 million” uniques, and Zillow was claiming 36 million. Note that Zillow hit 25 million uniques in Q3 of 2011. They added 11 million uniques — almost half of Trulia’s total traffic and over half of Realtor.com’s total traffic — in a year.

Unless Trulia and Realtor.com make some real serious moves in 2013, I see no reason to think that this gap won’t grow even larger.

Realtor.com doesn’t have “subscribers” so I can’t look at that comparison, but Trulia does. And they’re not too far behind Zillow. Trulia claims about 23,000 subscribers at the end of Q3 vs. about 27,000 for Zillow. That’s close enough to be a tie, in my book. But Trulia had 17,000 subscribers in Q3/2011 for growth of about 34% while Zillow had 15,000 for growth of 80%; that’s not good for Trulia.

There are likely hundreds of details and reasons here, but I look at the big picture stories of 2012. For public companies, those are acquisitions.

- Zillow acquired Rentjuice, Buyfolio, Mortech, and Hotpads in 2012.

- Trulia acquired no one.

- Realtor.com acquired Relocation.com.

Given #2 above, about the coming importance of rentals, and given the importance of mobile to real estate, what would you think looking at the list of acquisitions above?

Well, I don’t know about you, but I do know what Wall Street types by way of SeekingAlpha think:

Zillow has long been focused primarily on the residential sale market and to a lesser extent the rental market; however, with its recent purchase of HotPads, the company will now have access to a much larger pool of rental properties that should attract more consumers to its site in search of rental properties.

And what’s more, SeekingAlpha is seeing now what I saw coming ten months earlier. You might disagree with SeekingAlpha and with me, but at least know this is what Wall Street is seeing:

For real estate agents, the main issue at hand is whether or not they want to tap into the enormous base of customers visiting Zillow’s website and apps and what price they’re willing to pay for that access. Zillow now garners 36 million unique visitors per month. It has an extremely strong network effect: i.e., as more people come to the site, the greater the incentive is for agents to advertise their listings on the site and gain access to those home buyers and renters, and the greater the number of listings the more valuable it is for people coming to the site. It is now becoming an essential tool for people in the real estate industry because of the access they get to an enormous customer base. (Emphasis mine)

If we see Realtor.com and Trulia get active and get serious in 2013, perhaps things won’t turn out the way I see them today. They could, given some of the recent hires at both companies. People like Alon Chaver, formerly of iHomeFinder, are serious smart players. I know Realtor.com is thinking long and hard about the rental space as well, while its new mobile app improvements are impressive as hell.

But on 2012 trends, it looks to me that Zillow should pull away decisively in 2013.

Conclusion

Well, given my wonderfully terrible record in 2012, I suspect that you’ll join me in hoping that I’ll go another 2 for 7 or so in 2013. We will see at the end of the year how my crystal ball functioned.

But I will leave you with this general thought, and one that’s been building for quite some time.

The last couple of years have been all sorts of boring if you think about and comment on the real estate industry. It’s as if all of us have been holding our breaths for two years. I know I’m not alone in feeling as if there hasn’t been a real big innovation story in real estate in years and years. I know I’m not alone in feeling as if we’re all waiting for the other shoe to drop in the government action arena, while NAR is fighting desperately to minimize the damage. Maybe it was the 2012 elections that held everybody up; I do know those elections were likely the reason we haven’t seen major policy in 2012.

So as 2013 dawns, I feel as if we’re going to see resolutions across the board on a number of areas. Maybe we can finally let our breaths out and get to work on adjusting to the new world order after all.

See you on the Internet in 2013. This is my opening farewell.

Comments are closed.