I’ve gotten more than one request from readers to discuss the brutal analysis report on Zillow by Citron Research. I didn’t think I’d have much to add to a stock analyst’s report that tends to be heavy on financial metrics and such, but it turns out that the Citron Research report is indeed worth reading. And opining about. Seeing as how I don’t own any Zillow, haven’t shorted Zillow — or anyone else, and no one is paying me for this post… you may value my thoughts at what you’ve paid for them.

Fundamentally, Citron’s report isn’t an attack solely on Zillow; it’s an attack on the entire business model of Zillow, Trulia, Realtor.com, and everyone else in the “aggregation” business:

We can all agree the internet is not a new technology. Internet-generated leads to realtors have been getting sold for close to 15 years. Zillow itself has been around for seven years. If, after seven years and hundreds of millions of dollars of Wall Street’s money, all it has generated is a $100 million revenue run rate, why should the future be exponentially better than the past—especially with a plethora of well capitalized competition? That Zillow has captured a whopping 1% of real estate ad spend after seven years, definitively reveals a history of rejection of their model by their core market. This is not a broken business model; it is a business model that has never worked. (Emphasis in original.)

I think that’s going a step too far, and ignores some of the real simmering fault lines bubbling under the surface in the real estate industry. Since Citron isn’t new to covering the real estate technology business (“yes, we are veterans in this space”), I would have thought they’d be more aware of those fault lines. If they’re not, I invite them to subscribe to this here blog, since I often discuss them.

Citron’s Report, Summarized

A brief summary of Citron’s main points, I think, is warranted for those who don’t want to read the whole thing.

Basically, Citron believes that Zillow is not only overvalued but going “terminal” — meaning, the whole thing will come crashing down into failure and bankruptcy. They base this conclusion on three main factors:

- Zillow relies on telemarketing for sales

- Zillow’s customer base is finite and not spending much, and there is a history of failure

- Zillow’s customers hate them

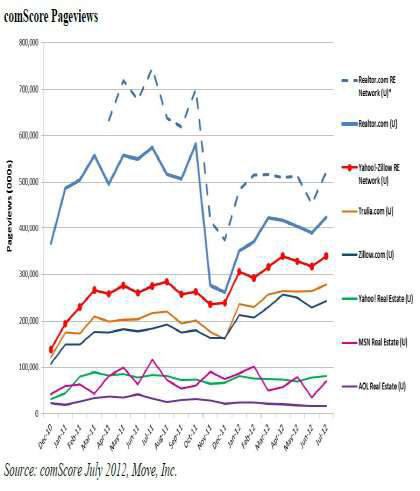

Citron adds a number of other facts to the discussion — some of which are new to me, since I don’t have comScore access. For example, the traffic growth is slowing:

But um, boys and girls at Citron… maybe my computer is totally jacked up and the colors aren’t correct, but that blue line you’ve circled in red showing the plunge… [EDIT: The picture I copied from PDF doesn’t have the red circle; please see the report itself] that looks like Realtor.com and the Realtor.com RE Network, not Zillow. Zillow looks to be under Trulia in dark blue. Plus, that chart says “comScore Pageviews” but the report talks about decline in unique visitors. I assume I don’t have to explain to smart analysts at Citron the difference between PageViews and Unique Visitors?

Strike One on credibility, no? But let’s ignore such basic errors, like using the wrong chart, and and highlighting the wrong company, to address the larger points — many of which are valid. The reason to do that, I think, isn’t to defend Zillow or anyone who bought Zillow. The reason is that Citron’s complaints are valid across the board, whether we’re talking about Zillow, Trulia, Realtor.com, FrontDoor, RealEstate.com, etc. etc.

Telemarketing Is Teh Suq!

The first point is that Zillow uses telemarketers:

It is Citron’s primary thesis that Zillow is a Web 1.0 business presenting itself as a Web 2.0 investment. The entire premise of Web 2.0 is that smart managing and publication of information interactively to users can scale tremendously, while costs remain fixed. But unlike Netflix, LinkedIn, and even Facebook, Zillow isn’t voyaging forth into an ever-expanding horizon of unlimited sized markets opening up on the internet. It generates virtually all of its revenue from U.S. real estate agents. And it does so the old fashioned way—by cold-calling them on the telephone. It’s been operating since 2006 more or less as it does today, and was consistently unprofitable, until the last two quarters.

As proof, Citron presents Zillow’s last two quarterly gross revenues, compared to its Sales and Marketing expense. It is a “heavyweight” sales company masquerading as a “web 2.0” leveraged technology play. The only way it has to grow revenues right now is with the increasing intensity of the sales effort. It’s not light and leverageable like LinkedIn, or OpenTable (Sales and mktg 21.4% of revenues) In reality, Zillow is more similar to Groupon than a Web 2.0 company such as LinkedIn or Open Table.

I think this criticism is entirely valid, at least so far. None of the “aggregators” are order-taker companies, with buyers beating down their doors to buy ads or Premier Agent programs. If you believe — as Citron does — that companies that have to actively sell their products and services are not high-valuation “Web 2.0” companies, but low-valuation “Web 1.0” companies… okay! That seems fair.

But that’s a valuation issue, not a “this company is going DOWN!” issue. I can easily see saying, “Self, we’re not going to pay 539 times trailing PE for $Z.” That strikes me, however, as a far cry from saying, “Self, $Z is going to be worth about as much as Pets.com.”

I think, however, that Citron isn’t looking at some of the more important longterm trends as it comes to this particular issue. I’ll address that down below.

Customer Base (aka, Real Estate Agents) Is Finite, And Not Spending Dough

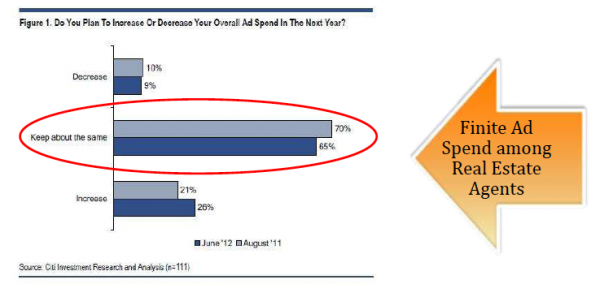

The second large point is that the customer base for Zillow is finite, and they’re simply not spending more on online advertising:

Every active real estate agent in an active market area gets calls from Zillow’s sales force weekly or monthly. Citron asks if there is a single professional real estate agent in the U.S. who doesn’t know what Zillow is or does?

The following charts, from Zillow’s own underwriter Citibank, in a recent analyst report that surveyed real estate agents, who are Zillow’s core customer base, are pivotally important to understanding Zillow’s prospects. If you own the stock, we recommend you read this sitting down.

That seems fair as well. Except…

I think the reliance by Citron on a flawed Citibank survey is where the analysis goes astray. The issue is with the term “Ad Spend”. My experience is that real estate brokers and agents think of “ad spend” very narrowly. “Ad spend” to a real estate guy means “buying newspaper ads, CPM ads, CPC keyword ads, etc.”

You know what “Ad Spend” doesn’t mean to real estate people? Setting up an IDX website. Email drip campaigns. Spending thousands of dollars on video. None of those appear to strike the average agent as an ‘ad spend’ but… of course those are all advertising efforts.

What else might be money spent on advertising that nonetheless doesn’t register in the survey respondent’s mind as “Ad Spend”? Franchise fees. MLS subscriptions. Money paid to hire “social media gurus” to do blogposts for the agent/broker. And so on.

In fact, my primary thesis is that almost all of what a broker or agent considers “technology spend” is in fact “ad spend”. Because very little of what is spent on technology in a brokerage or by an agent is related to what non-real estate companies spend on technology, such as automation (e.g., ATM’s) or customer service or data mining. Most of what an agent spends on “technology” is related to lead generation, i.e., advertising.

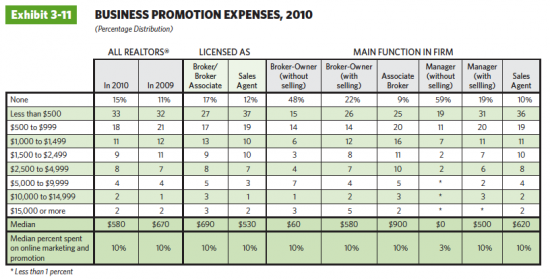

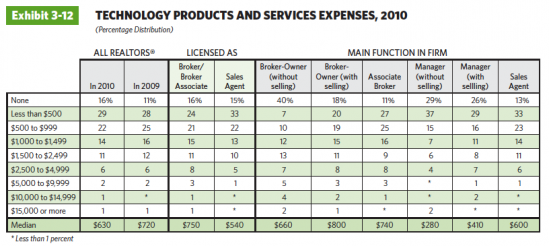

If you look at things that way — as I do — then what you find is that the “Ad Spend” might be significantly more than what the real estate agent thinks it is. Look at these three charts from the 2011 NAR Member Profile:

It isn’t clear to me how “Marketing of Services” and “Business Promotion” are different, but maybe one is direct advertising and the other is branding? I dunno.

What I do note, however, is that the median spend on Technology is $630 — down from $720 in 2009, but still there — vs. $550 for Marketing Services and $580 for Business Promotion. That’s not the full story, however, since some 16% of All REALTORS spent zero on technology. In 2011. Which is in the 21st century. Which means that 16% of All REALTORS need to leave the business immediately.

40% of Broker-Owners and 13% of Sales Agents spent ZERO on Technology in 2010. Which is in the 21st century. 16% of “All REALTORS” spent nothing on technology. To count such people in the “market size” is simply silly. For that matter, in an era where having a cellphone plan of any kind will cost you a couple of hundred dollars a month, treating ANY real estate agent/broker who spent less than $1000 per year on “technology” as part of the market is questionable.

And that number is 67% of All Realtors, or 670,000 out of the 1 million that Citron uses to bash on ZTR, saying specifically that Zillow only has 2.3% market share despite millions spent on sales. But… I don’t know… that 23,000 or so Premier Agents number looks a whole lot healthier to me if you look at the Market as being more like 330K instead of 1 million.

More importantly, however, 10% of All REALTORS spend more than $2,500 a year on “Technology”. Keep that fact in mind.

What these people were thinking when they responded to the survey, I don’t know. But I do know that Zillow doesn’t think of “Ad Spend” in the narrow way that its underwriters and others think of it. From my previous post on the subject:

Second, both Spencer and Chad Cohen (the CFO) mentioned a staggering number: real estate agents generate $60 billion in commissions, and spend 10% or $6 billion every year marketing both themselves and their clients’ properties. But they both mentioned that online advertising is only a small portion of that number. So one might naturally ask, where is the bulk of that money being spent then?

I’m not aware of any definitive research on the subject, but my gut tells me that most of that $6 billion is spent on “technology tools” such as IDX websites, CRM systems, transaction management, mobile technology, video, virtual tours, photography, social media marketing and the like. If your current business lies in one of these areas, I’d start listening to future Zillow earnings calls carefully if I were you.

Citron Research thinks Zillow’s focus on CRM and such is nonsense on stilts:

And to prove the current model is not working—the company is now focused on shifting that model from becoming a marketing channel to a software platform for agents, and to other businesses such as rentals, that have little to no synergy with their current business.

Let’s just say that I disagree with Citron. Becoming a software platform for agents, centered around a powerful lead generation online and mobile platform, isn’t merely synergistic with Zillow’s (and Realtor’s and Trulia’s) current business, but is in fact an extension of their current business.

If it were not, why would so many in the real estate industry feel so threatened by these companies moving into the “software platform” space? Remember the kerfuffle over MLS’s cutting off Diverse Solutions?

Zillow’s Customers Hate Them

Citron Research makes another true statement, at least partially, when they say that brokers and agents despise Zillow:

Zillow takes the intellectual property of individual realtors (syndicated residential real estate listings), mixes it together with some other content, and displays it for users. Realtors typically perceive that Zillow is re-branding their listings as its own, and then promptly tries to sell ” the lead” (generated by advertising the listing agent) right back to the realtor who generated the listing in the first place. This has been the cause of much of the backlash. To make matters worse, visitors to the site are not always matched with a qualified broker, as Zillow will present a “Real Estate Professional” that might not specialize in that area…just because they paid for the lead.

For those of us who have been following the Syndication War of 2010-2012, this is old news. Citron’s take on this is that because brokers and agents are so mad at Zillow, the backlash will be severe, and Zillow will never sell more ads or subscriptions to customers who hate them.

This point of view, of course, overlooks some significant developments.

Note that Victor Lund, of WAVGroup, one of the biggest opponents of syndication and one of the guys who really banged the drum against the “three-headed monster”, advised Howard Hanna on the Zillow deal.

I am on record as saying that the whole Syndication Wars are now over. The Real Estate Tech Armistice is coming, and it will be driven by mobile.

As I wrote a while back:

But the real fly in the ointment, it occurs to me, is that the anti-syndication folks — who, by the way, are entirely justified in their frustration — are fighting over an exhausted oil well. Sure, there are a few barrels left in there, I suppose, but the big boys have already moved on to the next arena: mobile.

Consider that a mere ten years ago, Microsoft was the biggest, baddest kid on the block. Today, they’re an object of faintly scornful pity. The biggest rivalry in technology today is between Apple and Google… because of mobile. And Google pretty much owns the Internet. Doesn’t matter. The real battle is over who will control mobile and the apps that have become so important in that world.

And recent information shows that ZTR are blowing mobile out of the water. We’re talking triple digit percentage growth year over year. The hundreds of millions that the aggregators are dumping into technology development… how much of that do you suppose is going to the dotcom side vs. the mobile app side?

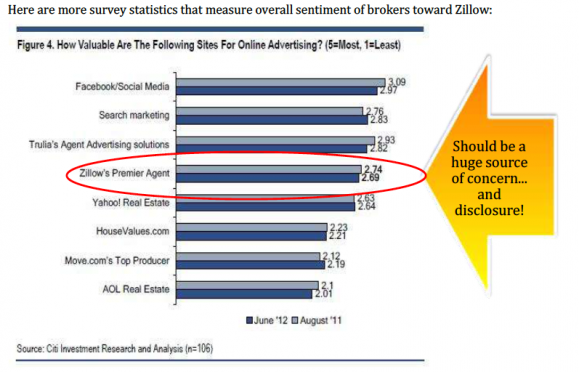

Citron’s assumption appears to be that brokers and agents who hate Zillow (and the others) will not buy stuff from Zillow and others and go it on their own:

So… first of all, “Search Marketing” doesn’t exist in the AppStores of the world — neither Apple’s nor Android’s.

Second, Facebook/Social Media tops the Most Valuable list for online advertising? That requires real explication, which I won’t do here since I’m over 2300 words already, but in brief… putting listings on social media sites is a waste of money. The way that social media actually works to generate value is far more subtle, far more personal, and far less impactful on Zillow/Trulia/Realtor.com’s prospects. Especially once you throw mobile into the equation. Short version: Nobody goes on Facebook to search for a house.

So in the mobile future of ours, once you throw out Facebook and Search Marketing — neither of which apply to buyers looking for a house — we’re left with… Trulia Agent Advertising solutions, Zillow’s Premier Agent, Yahoo! Real Estate, HouseValues.com, and so on.

And while anybody can pay some template website developer $9.99 a month to throw something up there, and rely on the Great God Google to drive them traffic, that mechanic simply doesn’t exist when it comes to the uber-competitive mobile apps space.

Terminal business? I don’t think so.

What is far more likely to happen over the next couple of years is not customer hatred bankrupting Zillow et. al., but customer acquiescence to the Facts of Life — just as Howard Hanna did — as the gap between the aggregators and the brokers continues to grow on the mobile front. Brokers and agents will come to realize that they cannot compete with Big Technology, and that they might as well figure out a way to partner with them and compete with other brokers and agents instead.

Other Rumblings and Conclusion

Some of the other rumblings that Citron Research missed are things like the tension around IDX, tension around MLS providing tools to all members that “level the playing field” too much for some brokers’ tastes, and so on. Citron Research is missing some of the subterranean conversations going on about agent ratings, value of Associations, even the nature of buyer agency. Any single one of those things can blow up and completely change the calculations. For example, if IDX does indeed go away (which I think is at least possible, if not probable), then companies like Zillow, Trulia and REALTOR.com become far more valuable to brokers and agents.

But you know what doesn’t change no matter what happens inside the industry? What consumers do. And that they love going to the big portals on the web as well as on the mobile apps is simply indisputable. That shift in consumer behavior will ultimately drive industry behavior.

If the choice for an agent or a broker is to pay Zillow/Trulia/Realtor.com a couple of thousand dollars a year to get not just leads but technology products that replace their lead-generating technology spends, or to spend a couple hundred million to build and market mobile platforms… I don’t think it’s that difficult a choice.

Now, this doesn’t mean that Zillow the company can’t go bankrupt. Of course it can. Nor does it mean that I think their sky-high valuation is justified; that’s for the investor to decide. I don’t actively invest in stocks so I never think about it. The insider sales figures that Citron writes about are worth considering if you’re an investor. But that’s all Wall Street stuff to me, and I don’t work there.

So I think Citron Research makes a very strong case. I wouldn’t think an investor reading that report and deciding to short Zillow is making a crazy mistake. But I do think Citron goes a step too far in claiming that the entire online real estate space is doomed and that the aggregators are pursuing a business model that has never worked, and my implication, could never work.

There have been too many changes over the last decade (when Citron started covering Zillow) and will be too many changes going forward to simply say “that never worked before” without looking a little deeper.

-rsh

PS: Damn, someone really should pay me to do buy-side analysis….